A Guide to Payroll Processing in India

Qandle

MAY 16, 2023

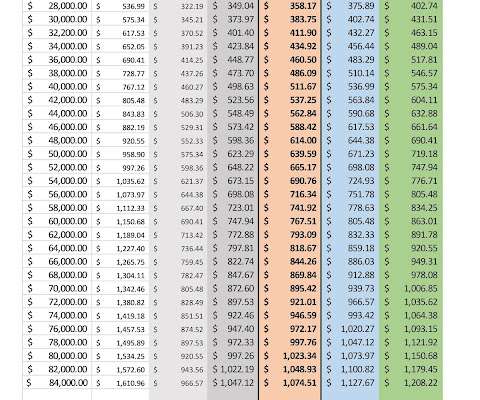

If you are a business owner, HR manager, or payroll administrator in India, understanding payroll processing is essential for your business’s smooth operation. From calculating employee salaries to managing taxes and deductions, payroll processing is a critical aspect of any business. What is payroll?

Let's personalize your content