Employees and Employers Save with Cafeteria Plans

InterWest Insurance Services

OCTOBER 27, 2022

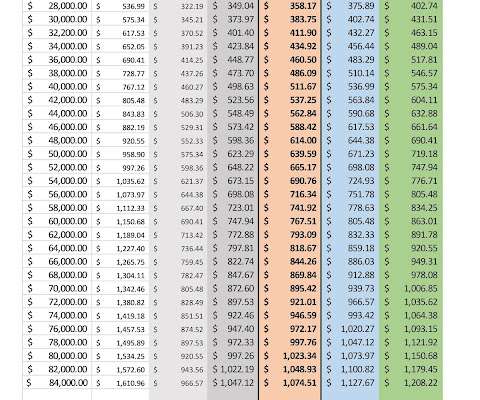

As health care costs continue rising and employees are being asked to shoulder more of the expense burden, you can help them by offering a tax-advantaged plan that allows them to save for medical expenses. Employees can save an average of 30% in federal, state and local taxes on items they already pay for out of pocket.

Let's personalize your content