Are Payroll Deductions for Health Insurance Pre-Tax? The Answer You Need to Know

Patriot Software

JUNE 21, 2021

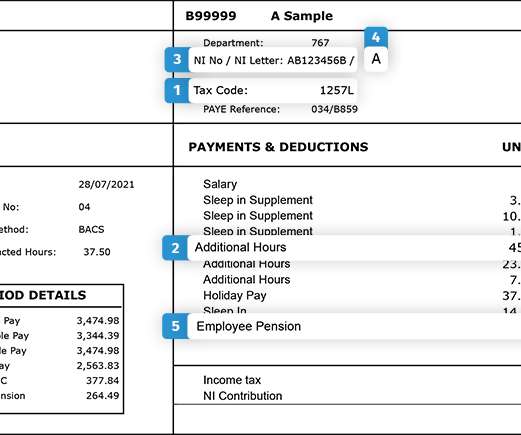

Providing health insurance benefits to your employees can leave you with a lot of questions. If you have your employees contribute to their premiums, you have to know how to deduct the cost from their gross pay. But, are payroll deductions for health insurance pre-tax?

Let's personalize your content