Employee Benefits: A Key Part of Job Compensation

Money Talk

AUGUST 18, 2022

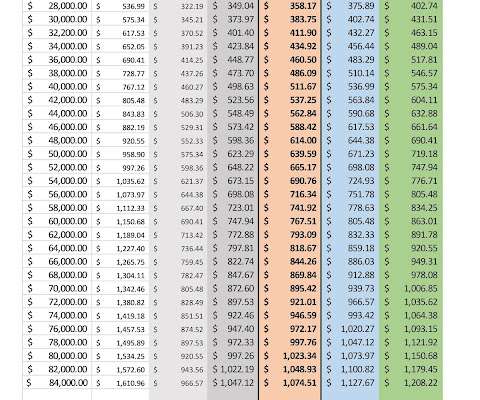

employee benefits generally equal 25% to 50% of a worker’s gross pay. This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation. Also known as “fringe” (short for fringe benefits) or “perks.”

Let's personalize your content