A Handy Guide to the Payroll Register

Patriot Software

NOVEMBER 3, 2021

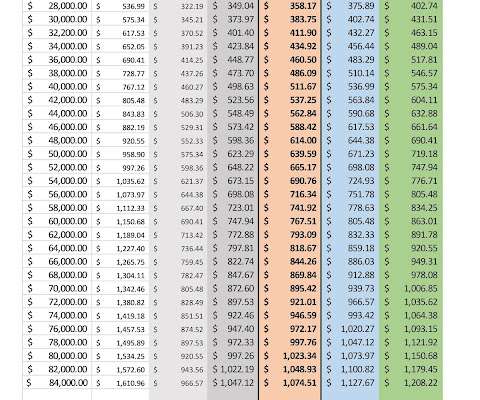

Payroll has a lot of moving parts to keep track of: employee hours, gross pay, net pay, payroll taxes, employee deductions, employer contributions, and the list goes on. Seeing all of that information in one place would be a dream come true, right? That’s where the payroll register comes in.

Let's personalize your content