Salary Sacrifice

Sodexo Engage

NOVEMBER 19, 2024

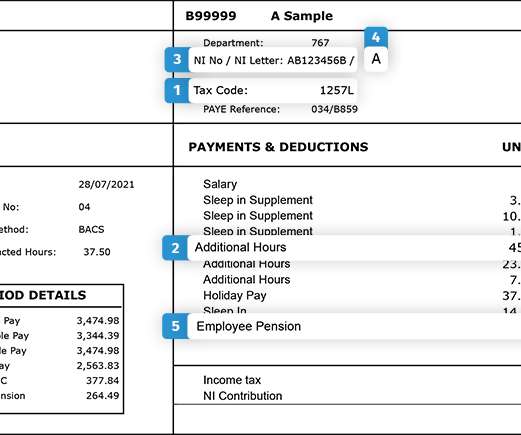

Salary Sacrifice mariana.nunes Tue, 11/19/2024 - 22:01 Salary Sacrifice and Your Business Cost-Savings Strategy The Autumn Budget and recent changes to the Employee Rights Bill 2024 reflect the changing landscape, putting more power in the hands of the employee. What does salary sacrifice mean? Our team will contact you.

Let's personalize your content