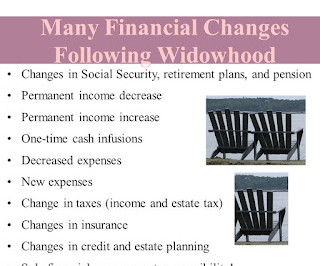

Planning Ahead for Widowhood: Changed Income and Expenses

Money Talk

SEPTEMBER 12, 2024

If the husband dies first, the wife is left with $1,250 (50% of husband’s pension), $800-wife’s pension, and $2,000 (highest Social Security) for income of $4,050 ($48,600 annually). If the wife dies first, the husband might receive a higher pension benefit because there will no longer be a reduction for spousal benefits.

Let's personalize your content