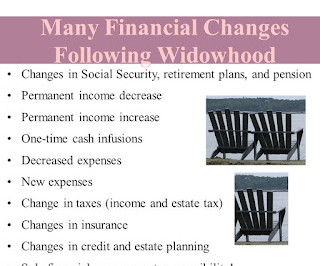

Planning Ahead for Widowhood: Changed Income and Expenses

Money Talk

SEPTEMBER 12, 2024

A married couple has four monthly income streams: $2,500- husband’s pension, $2,000- husband’s Social Security, $800- wife’s pension, and $1,500- wife’s Social Security for a total of $6,800 ($81,600 annually). The wife’s pension and Social Security would go away, however, which could still result in a decrease in household income.

Let's personalize your content