Longevity Risk: Insights From Recent Seminars

Money Talk

SEPTEMBER 28, 2023

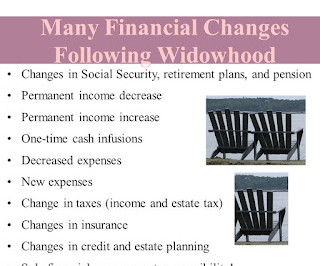

Below are six take-aways about some recent seminars that I attended about longevity risk: Ticking Time Bomb - One speaker called longevity risk a “ticking time bomb” in financial planning. For example, instead of two Social Security checks, there will be one, along with a reduced (survivor) pension benefit.

Let's personalize your content