Longevity Risk: Insights From Recent Seminars

Money Talk

SEPTEMBER 28, 2023

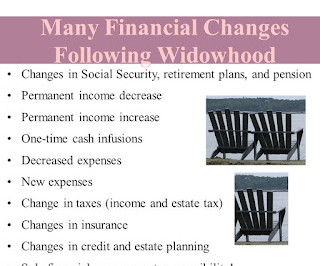

It should include essential living expenses, discretionary living expenses, and guaranteed sources of income such as Social Security, an annuity, or a pension. For example, instead of two Social Security checks, there will be one, along with a reduced (survivor) pension benefit.

Let's personalize your content