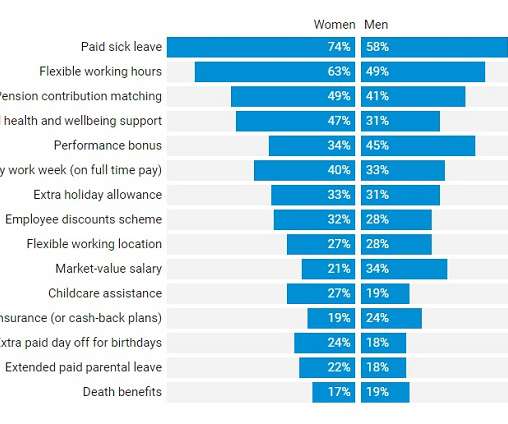

What actions can employers take to close the gender pensions gap?

Employee Benefits

FEBRUARY 12, 2024

More employers could introduce gender inclusive paid parental leave to prevent and try to close gender pension gaps. The Pensions (Extension of Automatic-Enrolment) (No. 2) Bill will remove the lower earnings limit, enabling more employees to pay into a pension. The Pensions (Extension of Automatic-Enrolment) (No.

Let's personalize your content