New Overtime Rules 2024: What Employers Need to Know

HR Lineup

JULY 1, 2024

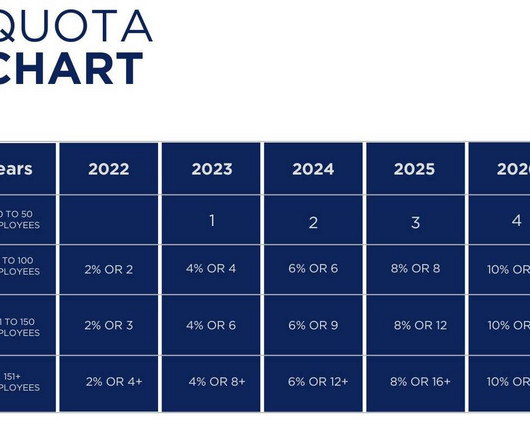

Department of Labor (DOL), aim to adjust the salary threshold for overtime eligibility. Increased Salary Threshold for Exempt Employees New Threshold: The salary threshold for exempt employees has been raised to $55,000 per year. This audit should include a review of job duties, salary levels, and hours worked.

Let's personalize your content