Tax Exemption on Overtime Pay, What HR needs to know for 2025

HR Digest

FEBRUARY 26, 2025

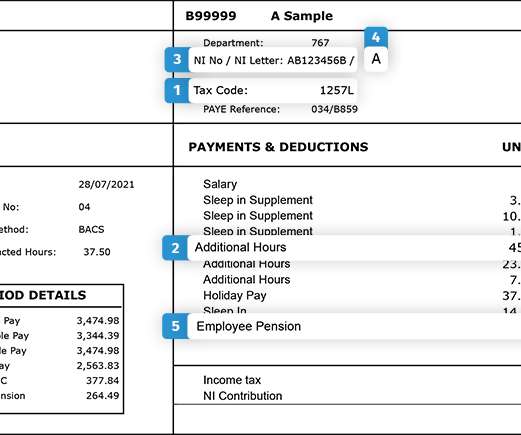

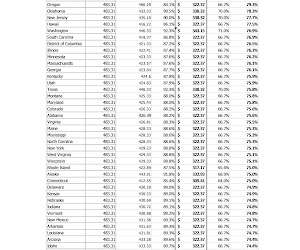

Since yesterday, overtime pay taxes have dominated headlines, driven by a proposal from the current administration to exempt overtime earnings from federal income tax. Beyond the paycheck, this overtime tax policy could reshape workforce planning, employee morale, employee incentives and organizational strategies.

Let's personalize your content