Your Guide to Take-home Pay

Patriot Software

FEBRUARY 25, 2019

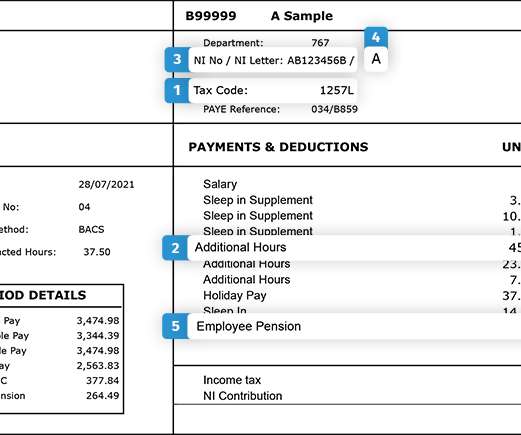

After you subtract all of the taxes and other deductions, money left over is considered take-home pay. Read on to learn more about what is take-home pay and how to calculate it. What is take home pay? Take-home pay may also be called net pay.

Let's personalize your content