Can Payroll Services Handle Direct Deposit?

Patriot Software

FEBRUARY 22, 2024

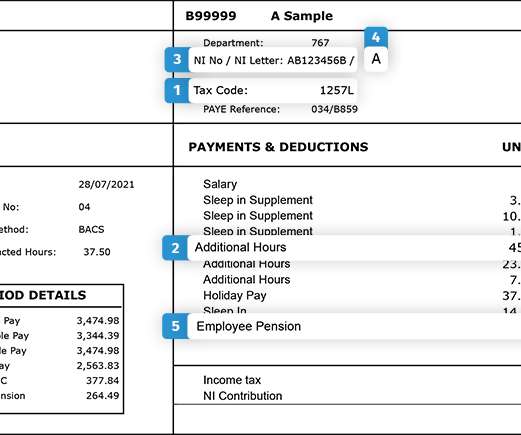

Most employers handle direct deposit through their payroll software. Payroll services calculate employees’ wages, taxes and deductions, and take-home pay. […] Read More Direct deposit is a convenient payment method for employees, who receive their paycheck quickly and securely on payday.

Let's personalize your content