3 Reasons to Boost Your Employee Benefits Offerings in 2020

Achievers

DECEMBER 16, 2019

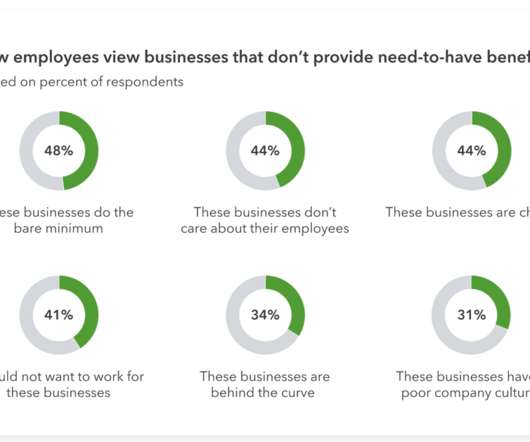

Naturally, most businesses can’t afford the king suite of benefits—unlimited PTO, free insurance, etc. Given the choice between working somewhere with great benefits and somewhere with the bare minimum, anyone would choose the business with more PTO. A matching 401(k) or pension. Ten years ago, that wasn’t a problem.

Let's personalize your content