10 Best Tax Practice Management Software 2024

HR Lineup

DECEMBER 5, 2023

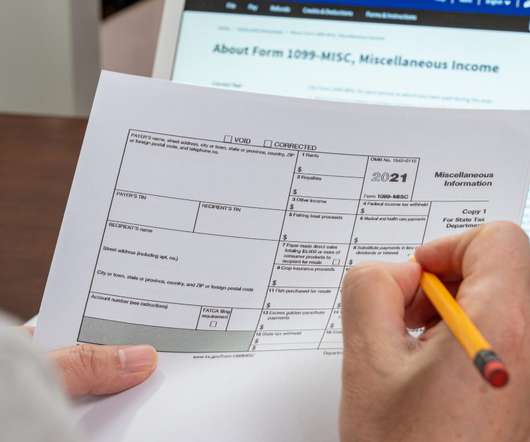

In the fast-paced world of taxation and financial management, staying ahead of the curve is crucial for tax professionals. As we step into 2024, the demand for efficient, user-friendly, and comprehensive tax practice management software has never been higher.

Let's personalize your content