APA Bookshelf

PayrollOrg

JANUARY 17, 2022

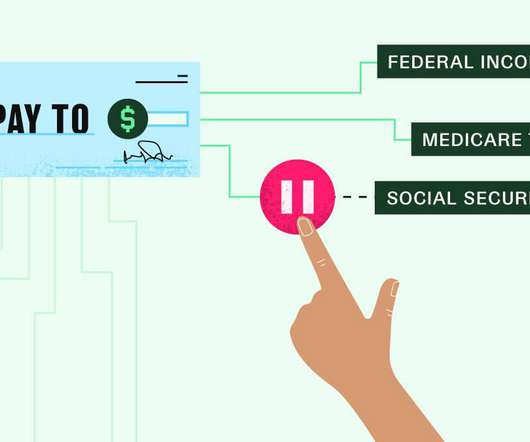

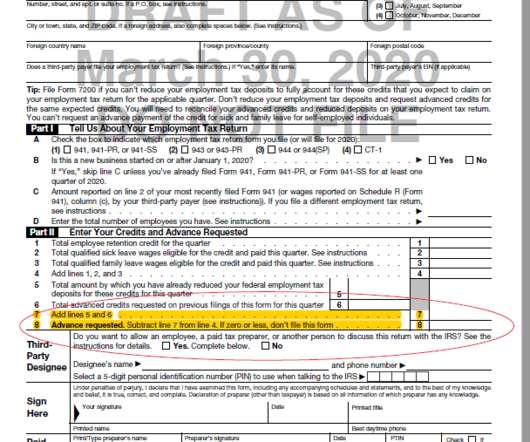

American Payroll Association. Go > Payroll Currently – All Issues. Payroll Currently – Volume 29 – 2021. Payroll Currently – Volume 30 – 2022. PayState Update – Volume 22 – 2020. Your Online Payroll Compliance & Research-Ready Library. Federal Payroll Tax Laws & Regulations.

Let's personalize your content