Be Prepared for Employee Questions as IRS Begins Accepting 2021 Tax Returns

PayrollOrg

JANUARY 25, 2022

On January 24, the IRS opened the tax filing season for taxpayers.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

PayrollOrg

JANUARY 25, 2022

On January 24, the IRS opened the tax filing season for taxpayers.

Money Talk

DECEMBER 29, 2021

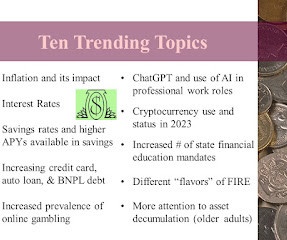

Between December 11 and 31, I have been tweeting about 21 key financial events that took place during 2021 using the hashtag #21MoneyTrends2021. Income and Jobs- An unprecedented 1 in 4 American workers quit jobs in 2021 as people re-evaluated work requirements, personal values, career options, and work-life balance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Understanding Group Medicare for an Aging Workforce: Key Considerations for HR Leaders

More Than a Benefit: Group Medicare and the Psychology of Retirement

Take It Personel-ly

MARCH 22, 2021

As tax season rolls around, it can be a time-consuming and challenging process for small business owners to get things in order. tax code can be complex, and finding yourself out of compliance could lead to steep penalties. Developing good tax prep habits and maintaining accurate records and practices all year long can […].

PayrollOrg

JANUARY 17, 2022

Payroll Currently – Volume 29 – 2021. PayState Update – Volume 23 – 2021. Federal Payroll Tax Laws & Regulations. Federal Payroll Tax Laws & Regulations contains payroll-related sections of the Internal Revenue Code and Internal Revenue Service regulations. Federal Payroll Non-Tax Laws & Regulations.

Money Talk

MAY 18, 2022

Now that 2021 income tax season has been over for a month and the dust has settled, it is time to start some serious tax planning for 2022. Planning now provides seven months to take action and/or implement changes to avoid a stressful “tax scramble” at the end of the year. 401(k), 403(b), and traditional IRA).

HR Lineup

SEPTEMBER 1, 2021

Any business requires the best payroll software 2021 to manage its employees’ payroll. The software should be very effective to manage taxes and employee benefits. If you are looking for top payroll software in 2021, we recommend them below. Our List of Top Payroll Software of 2021. Quickbooks Payroll.

Money Talk

JUNE 8, 2022

A big concern of people with multiple income streams is adequate tax withholding. Nobody want to pay the IRS tax underpayment penalty, which is 0.5% of the amount owed for each month or partial month of unpaid taxes. mutual fund dividend and capital gain distributions), and tax withholding. In other instances (e.g.,

HR Lineup

SEPTEMBER 15, 2021

Below are the best HRIS software solutions 2021 that will help you manage your workforce effectively. Our List of Best HRIS Systems 2021. The post Best HRIS Software Solutions 2021 appeared first on HR Lineup. Since the COVID-19 pandemic, the last thing you want to do as an employer is put your workers at risk.

HR Lineup

SEPTEMBER 23, 2021

That is why you should upgrade to the best compensation management software 2021 with modern and personalized features. . With QuickBooks, small businesses can prepare for their tax returns, by fully eliminating the need for manual processes. The post 5 Best Compensation Management Software 2021 appeared first on HR Lineup.

Money Talk

APRIL 14, 2022

The 2021 income tax season will soon be in the history books. With income tax calculations still fresh in our heads, this is a great time to do some tax planning for 2022. Changed Income- A change in household income this year- up or down- will affect income taxes. Specific rules for claiming dependents apply.

PayrollOrg

JANUARY 25, 2022

In this December 2021 issue of Compliance TV: President signs infrastructure bill that ends ERC early; Reminder that payment of deferred social security tax from 2020 Is due soon; IRS announces 2022 retirement plan contribution and benefit limits; and IRS announces 2022 COLAs for transportation fringes, FSA deferrals, foreign earned income exclusion, (..)

HR Digest

APRIL 4, 2025

The upcoming No Tax on Overtime (H.R. With the proposal still in limbo around federal and state tax policies, many are eager to understand how this tax exemption on overtime pay could impact their final paychecks. In this article, well answer key questions around No Tax on Overtime in Virginia.

Money Talk

JANUARY 13, 2022

In this post, I continue my discussion of tips from webinars, podcasts, and virtual conferences that I heard during the last quarter of 2021. Think Tax Efficiency - Plan ahead to pay the least amount of taxes legally due on retirement savings. Tax efficiency can have a significant impact on portfolio longevity.

BerniePortal

MARCH 2, 2021

Tax season is busy for employers on both a personal and professional level. From compliance matters to deadlines, this resource will help answer questions your employees may have about tax season.

Money Talk

JANUARY 19, 2022

In this post, I continue my discussion of tips from webinars, podcasts, and virtual conferences that I heard during the last quarter of 2021. Make Tax-Advantaged Gifts - Consider “bunching” charitable donations with other tax deductions (e.g., state income tax and local property tax) every so often (e.g.,

BerniePortal

MARCH 29, 2021

With an extension to the federal tax return deadline and other changes, what should employees know this tax season? After a year of deferred deadlines, employment law changes, and workplace adjustments, employees have had a lot to keep track of both inside and outside of the office.

Money Talk

AUGUST 26, 2021

A recent article in the Wall Street Journal described a new investment trend: “Wealthy Americans eyeing potential tax increases are helping drive record amounts of money into municipal bond funds.” It also went on to state that tax-free U.S. With these trends in mind, now is a good time to review some basics about tax-free (a.k.a.,

InterWest Insurance Services

APRIL 24, 2025

HDHPs surged in popularity between 2013 and 2021, peaking at 55.7% When HDHPs still make sense Despite the downturn, HDHPs aren’t vanishing, and they are still a good choice for certain groups: Young and healthy workers: People who rarely use medical services can benefit from the low premiums and use HSAs to build tax-free savings.

PeopleKeep

NOVEMBER 5, 2020

In practical terms, that means small businesses are limited in how much tax-free money they can offer their employees through the benefit. In 2021, small businesses may offer up to $5,300 per self-only employee and up to $10,700 per employee with a family.

Money Talk

JULY 28, 2021

Last month, I wrote a blog post for the Military Families Learning Network about “nuts and bolts” of the advance child tax credit (ACTC). To recap, the ACTC is an advance payment of half of the expanded child tax credit (CTC) available under the American Rescue Plan. The remainder of the credit gets settled up on 2021 tax returns.

BerniePortal

JANUARY 13, 2021

In December 2020, the IRS released the final version of the 2021 Form W-4. The important tax form includes only very few changes from the 2020 version, which was overhauled to feature more accurate withholding information in a simpler, more accurate, and more private document. Here's what you need to know.

Money Talk

MAY 4, 2023

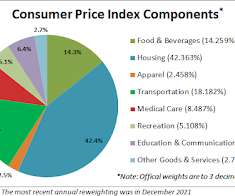

had an ascending 5% inflation rate (CPI) in May 2021 and a descending 5% CPI in March 2023 and many higher inflation rates in between. Inflation-induced price hikes on goods and services are like a regressive sales tax and hurt those with low incomes the most.

Money Talk

JANUARY 26, 2022

One of the most daunting financial aspects of retirement, especially for people who have been diligent savers throughout their working years, is taking required minimum distributions (RMDs) from their tax-deferred retirement savings accounts beginning at age 72. Example : $500,000 account balance on December 31, 2021 and age 72 in 2022.

McDermott Will & Emery Employee Benefits

JULY 26, 2022

Last month, the Washington Court of Appeals affirmed a lower court’s decision to dismiss a challenge to the recently enacted payroll expense tax in Seattle, WA. The tax, which went into effect on January 1, 2021, […]. Seattle Metro. Chamber of Commerce v. City of Seattle, No. 82830-4-I, 2022 WL 2206828 (Wash.

PeopleKeep

MARCH 15, 2021

With the recent passage of the American Rescue Plan Act of 2021 , there’s been a lot of talk about the changes made to premium tax credits and lowering health insurance costs—but what exactly are premium tax credits, and what do they have to do with how much you pay for health insurance?

BerniePortal

OCTOBER 13, 2020

13, 2020, that the wage cap for Social Security payroll taxes will increase in 2021. The Social Security Administration (SSA) announced on Oct. What do employers need to know about this update?

Patriot Software

DECEMBER 28, 2020

A new type of payroll tax is coming your way in 2021. Learn all about the Eugene Community Safety Payroll tax and whether or not you need to withhold and remit it to the city. What is the Eugene Community Safety Payroll Tax? Specifically, attention employers in Eugene, Oregon. The Eugene Community […] READ MORE.

BerniePortal

JUNE 21, 2021

In late May 2021, the Biden administration released the federal budget for the Fiscal Year 2022 as well as the White House’s proposed tax plans for the same time period. Find out what’s included in the U.S. Treasury “Green Book” and how it may impact American employers around the country.

Business Management Daily

DECEMBER 7, 2021

share of Social Security taxes last year, the time to make your first payment is approaching quickly. You’ll receive a separate notice for each quarter you deferred the deposit of your taxes. 31, 2021, and Dec. Your make-up payments must be made separately from your other tax deposits. If you deferred depositing your 6.2%

BerniePortal

JUNE 16, 2021

In spring 2021, Congress passed the American Rescue Plan Act of 2021 (ARPA) , which introduced a flurry of changes to U.S. Included among the many updates were several important adjustments to the child tax credit (CTC). Find out how the tool works and what employees need to know about the child tax credit.

Patriot Software

DECEMBER 8, 2021

There’s a new personal income tax that went into effect in 2021, and it may impact both you and your employees. What is this new tax in town, you ask? The Multnomah County Preschool for All tax. If you’re an employer in Oregon (specifically in Multnomah County), listen up.

Money Talk

JULY 13, 2022

Simply divide the December 31, 2021 balance in each of your tax-deferred accounts by the appropriate age divisor in the Uniform Lifetime Table to determine the minimum amount (which is taxable income) that must be withdrawn. There are five different tiers of IRMAA tax. Start planning now at mid-year.

Patriot Software

OCTOBER 6, 2021

The benefit itself isn’t new, but it got a tax-exemption makeover thanks to the CARES Act and Consolidated Appropriations Act. If you’re looking for a new benefit to offer employees, you might consider employer student loan repayment. The result? An up-and-coming employee benefit hitting businesses nationwide.

PeopleKeep

OCTOBER 6, 2021

One alternative that has been growing in popularity is the individual coverage health reimbursement arrangement (ICHRA)—an IRS-approved health benefit that allows employers to reimburse their employees, tax-free, for their own individual health insurance premiums and qualifying out-of-pocket medical expenses.

Griffin Benefits

DECEMBER 30, 2021

Thousands of companies turned to JP Griffin Group for guidance on employee benefits topics in 2021. TOP TEN BLOG POSTS OF 2021. A consolidated list of 2022 IRS contribution limits for tax-advantaged employee benefits accounts such as HSAs, FSAs, 401(k)s, QSEHRA, transportation, and adoption benefits. TOP FIVE DOWNLOADS OF 2021.

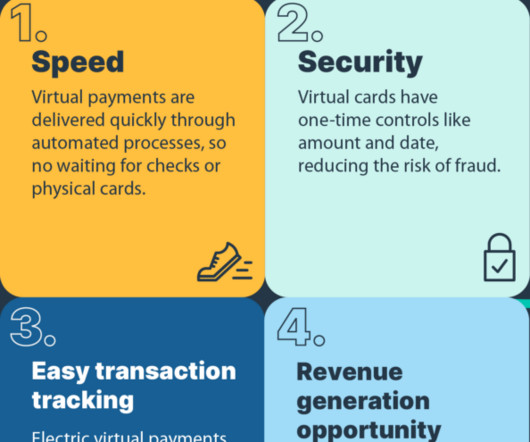

WEX Inc.

JULY 31, 2024

Greater security In fact, in 2021, the Federal Trade Commission (FTC) received nearly 390,000 reports of credit card fraud , making it one of the most prevalent types of fraud in the U.S. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax, and investment advisers.

Money Talk

JANUARY 26, 2023

lawn care, tax preparer, hair dresser), natural gas for home heating, electricity, and auto and homeowners insurance. In 2021, it was the reverse (i.e., Good news: the historical inflation rate from 1926- 2021 has been only 2.9%. 5+ for 12 eggs!), services (e.g., a lower past rate with a higher current rate).

Money Talk

JULY 21, 2022

Almost a year ago, in August 2021, I wrote a blog post for the OneOp Personal Finance team about inflation-fighting ideas for military families. At that time, many experts predicted that inflation would be “transitory” and subside quickly as supply chain “issues” related to the pandemic got resolved.

Money Talk

NOVEMBER 24, 2021

Last week, I attended the virtual 2021 AFCPE (Association for Financial Counseling and Planning Education) Symposium for financial educators, planners, counselors, coaches, researchers, and content creators worldwide. On the other side of the age spectrum, some older Gen Zers (age 9-24 in 2021) express “climate doom” concerns.

BerniePortal

MARCH 23, 2021

Congress passed the American Rescue Plan Act of 2021 (ARPA) in early March 2021, implementing dozens of changes to the U.S. Among these updates is an expanded and enhanced child tax credit (CTC), which offers a more generous—and flexible—benefit for qualifying parents and guardians.

Patriot Software

DECEMBER 20, 2021

The November 2021 Infrastructure Investment and Jobs Act ended the Employee Retention Credit (ERC) program earlier than expected. Originally slated to expire December 31, 2021, the ERC ended retroactively for most businesses on September 30, 2021. IRS Notice 2021-65 answers those questions.

Benefit Resource Inc.

NOVEMBER 10, 2021

The IRS released the 2022 contribution limits for Mass Transit, Parking, Medical FSA, and Adoption Assistance in Revenue Procedure 2021-45. Maximum Election : $280 / month (up from $270 / month in 2021). Maximum Annual Limit : $2,850 (up from $2,750 in 2021). Maximum Credit: $14,890 (up from $14,440 in 2021).

Benefit Resource Inc.

DECEMBER 2, 2021

A Dependent Care Flexible Spending Account (often shortened to ‘Dependent Care FSA’) is a pre-tax benefit account used to pay for eligible services such as preschool, summer day camp, before/after school programs, and child or adult daycare. 2022 Changes to Dependent Care. Who is Eligible?

Employee Benefits

JULY 3, 2023

Share incentive plans (Sips) were introduced in the UK in 2000 as a type of employee share scheme aimed at helping employees, who can purchase shares or be awarded free shares in the company, to save in a tax-efficient way. If the shares are sold after withdrawal, no capital gains tax is due. Are there any potential tax issues?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content