National Insurance saving could be used to boost workplace pension

Employee Benefits

MARCH 6, 2024

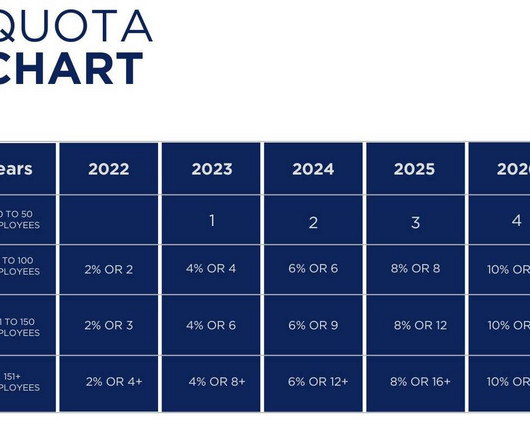

As announced in The Spring Budget, National Insurance (NI) is reducing from 10% to 8% from April 2024. a year in NI contributions and be able to pay an additional 1.03% of their salary into their workplace pension at no additional cost to them. When made into a pension contribution it is worth £206.39 1.53% £1,300.00

Let's personalize your content