Retirement and Taxes: "To" and "Through" Planning

Money Talk

JUNE 16, 2022

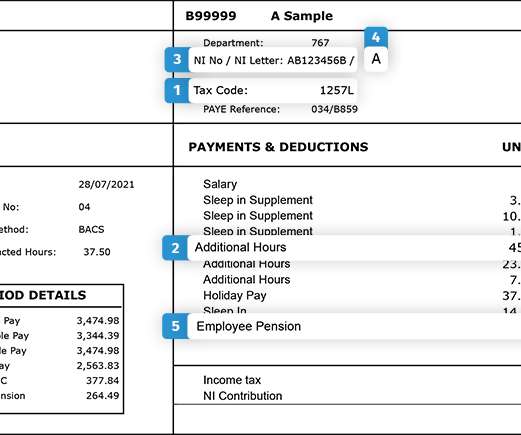

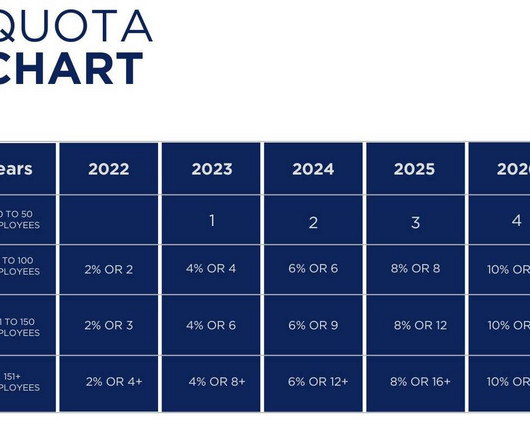

There are seven tax rates in effect through 2025: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Through Retirement” Planning ¨ Taxable Income Sources- Common types of taxable income in later life include pensions, distributions from workplace retirement accounts, and Social Security. How many years do you have before retirement?

Let's personalize your content