Top 5 reasons to check your payslip

cipHR

NOVEMBER 15, 2021

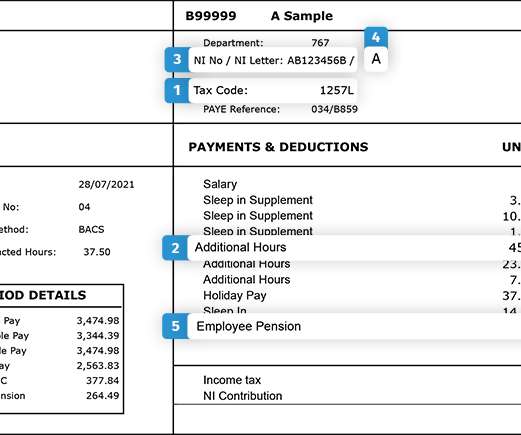

It’s worth remembering that it’s an employee’s responsibility to check they’re on the right tax code, as it impacts how much tax they pay – whether it’s too much tax or too little. For the 2021/22 tax year (and through to 2025/26), the tax code for most people under 65 who only have one job or pension is 1257L.

Let's personalize your content