Dementia prevention starts in the workplace

Employee Benefit News

MARCH 19, 2025

By 2026, dementia is expected to affect one in five older adults. Employers can help reduce this number.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Employee Benefit News

MARCH 19, 2025

By 2026, dementia is expected to affect one in five older adults. Employers can help reduce this number.

Best Money Moves

JANUARY 7, 2025

Moreover, employees view their employers as responsible for financial wellness efforts. According to MetLifes Employee Benefit Trends Study 2024 , 92% of employees want more consistent care from their employers. 2025 is the year to implement financial wellness benefits For employers, 2025 marks the window to act.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Understanding Group Medicare for an Aging Workforce: Key Considerations for HR Leaders

More Than a Benefit: Group Medicare and the Psychology of Retirement

HR Digest

AUGUST 25, 2023

By decoding the new EEOC strategic plan, HR leaders can get a better understanding of how the organization aims to address workplace discrimination and promote equal employment opportunities. Stay tuned to discover how the EEOC’s 2022-2026 strategic plan sets the stage for fostering inclusive and diverse workplaces across the nation.

Patriot Software

JULY 21, 2023

Beginning in 2026, Minnesota employers will be responsible for handling payroll deductions for the new Minnesota paid family leave program. The upcoming MN paid family leave means employers and employees pay into a state fund. The Land of 10,000 Lakes is the latest state to launch a paid family and medical leave program.

HR Digest

MARCH 1, 2025

Employers could lean harder on overtime instead of hiring which could serve as a cost-cutting move. It could be late 2025 at best, or early 2026 more likely. With wages lagging behind inflation, untaxed overtime offers breathing room. But its not all rosy. If those extra hours pay better, people might clamor for more shifts at work.

Employee Benefits

AUGUST 7, 2024

Credit: Hyejin Kang/Shutterstock Need to know: Employers should start planning now for the P11D changes to the reporting and paying of tax and Class 1A national insurance contributions (NICs) on benefits in kind, to ensure a smooth transition to the new system in April 2026. There may be some challenges for employers.

HR Digest

JANUARY 20, 2025

The company announced its intention to go on a cost-cutting mission last year, with an aim to simplify the business significantly by the end of 2026, so the news of the job cuts doesn’t come as a surprise. billion pounds) in savings it planned to ensure by the end of 2026. This was a quarter of the $2 billion (1.6

WEX Inc.

DECEMBER 18, 2024

ACA reporting deadlines The Affordable Care Act (ACA) mandates that employers file reports annually with the IRS and distribute 1095-C forms to employees. Employers must communicate these deadlines clearly to employees. Key dates October 3, 2025: Distribute QSEHRA notices to employees 90 days before the start of the 2026 plan year.

Workplace Insight

MAY 23, 2024

The new instalment of Pearson’s Skills Outlook series, ‘Reclaim the Clock: How Generative AI Can Power People at Work’ – looks ahead to 2026 and claims too identify the top 10 job tasks with the most time saved by using the technology, in five countries (Australia, Brazil, India, UK and US).

HR Digest

APRIL 4, 2025

bill has sparked curiosity among the nations workers and employers alike. If it clears these hurdles, No Tax on Overtime pay may rollout in late 2025 or early 2026. Employers must still comply with both state and federal regulations on overtime pay. Sales employees who work away from the employers premises.

3Sixty Insights

OCTOBER 3, 2024

We touched on the need to rethink the traditional 40-hour work week, which, as it approaches its 100th anniversary in 2026, is long overdue for retirement—especially in many modern professions. Michelle and I had a great conversation about the outdated work structures that are affecting both employee experience and productivity.

Money Talk

APRIL 14, 2022

Tax-Deferred Investing - One way to avoid a higher tax bracket is to increase tax-deductible contributions to an employer retirement plan (e.g., Pay particular attention if your projected income is close to a “breakpoint” for the next highest tax bracket so you can take proactive steps to stay below that number. 401(k), 403(b), 457, TSP).

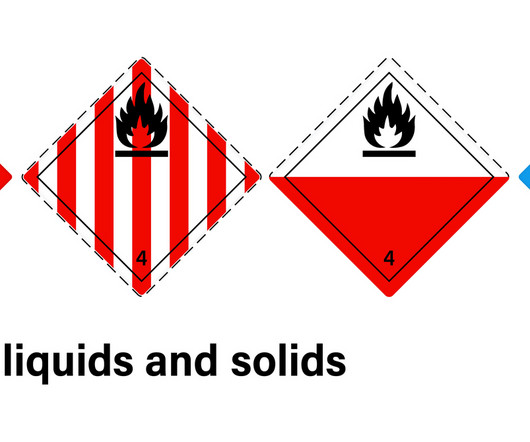

InterWest Insurance Services

JULY 16, 2024

19, 2026, while those that evaluate mixtures will have to comply by July 19, 2027. Second: Other employers will have to comply six months after those dates: July 19, 2026 for those that handle, store or use substances, and Jan. Employer takeaway HazCom citations are one of the most common citations that OSHA issues.

Employee Benefits

NOVEMBER 17, 2022

Autumn budget 2022: The government has decided to maintain the current freeze on employers’ national insurance (NI) contribution thresholds for a further two years. In addition, the employment allowance will be retained at a higher level of £5,000 until March 2026.

Employee Benefits

AUGUST 7, 2024

However, mandating payrolling of BIKs was introduced by a previous government; will Labour agree and pursue an implementation date of April 2026? Employers need to communicate with their employees that pay-as-you-earn (PAYE) income tax will be collected on benefits once payrolling is mandated.

McNees

MAY 25, 2022

Maryland and Delaware recently joined the growing list of states that have enacted legislation requiring employers to offer paid family and medical leave. Maryland’s new law will cover all employers with at least one employee in the state. Employers with 10 to 24 employees only need to offer parental leave.

Employee Benefits

SEPTEMBER 20, 2023

Societe Generale’s 2022 UK gender pay gap report, which covers employees at its London and international business, revealed that the median pay gap for hourly pay was 26.2%, higher than the average UK employer but less than the 30.1% French multinational financial services firm Societe Generale has invested €100 million euros (£865.4

HR Digest

APRIL 22, 2025

Employers operating in these states will need to prepare for the upcoming changes, and their HR and accounting teams will need to be on top of all the adjustments necessary to ensure the switch occurs smoothly. per hour in 2026 Some jurisdictions within prominent states are also raising the minimum wage later in 2025.

HR Digest

MARCH 12, 2025

As talk of a no tax on overtime bill in California swirls, alongside new overtime tax laws and a potential tax exemption update, workers and employers alike are left wondering: Will overtime still be taxed in 2025, or is Californias overtime tax exemption bill about to rewrite the rules? What is the no tax on overtime bill in California?

HR Digest

JANUARY 8, 2023

The law was passed in June 2020 and is expected to have been implemented in June 2026. To confirm their strictness with this law, organizations that fail to reach the appropriate quota by 2026 will eventually pay fines and risk losing certain positions on their boards. Law 3: The right to disconnect . Countries involved: Portugal.

Proskauer's Employee Benefits & Executive Compensa

DECEMBER 15, 2023

Act of 2022 (“SECURE 2.0”) was signed into law on December 29, 2022 as part of the 2023 Consolidated Appropriations Act, and included a myriad of required and optional plan design changes for retirement plan sponsors and employers (described in more detail here ). As previously discussed, the SECURE 2.0 Section 603 of SECURE 2.0

Workplace Insight

MAY 17, 2024

The project is expected to create significant employment opportunities and generate broader business prospects alongside the digital campus. With land purchase anticipated to be finalized next year, construction is set to begin in 2026.

Proskauer's Employee Benefits & Executive Compensa

JANUARY 16, 2024

Although Notice 2024-02 offers helpful guidance for employers and plan administrators, it does not include hotly anticipated guidance on SECURE 2.0 single employer 401(k) plan is generally treated as exempt from the automatic enrollment requirements, even if the spin-off occurs after December 28, 2022. Spin-Off from Pre-SECURE 2.0

HR Digest

MARCH 5, 2025

When workers keep more money, the ripple effects touch employers, families and communities. For Georgia employers, this isnt an abstract policy. Rhode Island: Senate Bill 2568 targets a temporary reprieve for 2025 and 2026, offering a test run for no tax on overtime laws by state. Alabama has done it, Georgia is close.

HR Digest

FEBRUARY 15, 2022

According to Gartner , 25% of individuals will spend at least one hour every day in the Metaverse for work, retail, education, social networking, and/or leisure by 2026. The Future of Work And Metaverse. Consider a Metaverse as the next evolution of the Internet, which began as separate bulletin boards and online destinations.

Employee Benefits

JUNE 3, 2024

It was calculated using the average of forecasts from the Bank of England and the Office for Budget Responsibility for 2024-25, 2025-26 and 2026-27. The policy stated that the 9.3% increase, which consists of three lots of 3% rises, is comparative to forecast 5.7% inflation rates over the next three years.

Employee Benefits

FEBRUARY 17, 2023

This is particularly the case where employees are making healthy contributions to their pension scheme and perhaps receiving matching employer contributions. and receives employer contributions of 10%, it is possible for their pension fund to reach £1,381,000 by the time they retire at 65.

Employee Benefits

APRIL 24, 2023

Looking at childcare provision in other countries , greater investment from government can bring down overall costs for employers to offer working parents more support. The aim is to replicate the subsidised model in Quebec and guarantee that by 2026, parents pay no more than an average of C$10 a day for childcare,” he says.

Insperity

OCTOBER 10, 2023

workers better prepare financially for retirement, at every stage of their employment journey. In requiring employers to take actions that can improve their employees’ financial wellness, the SECURE 2.0 employer-sponsored 401(k) plans. The Internal Revenue Service (IRS) will begin enforcing this provision in 2026.

Employee Benefits

JULY 18, 2024

Bedfordshire, Cambridgeshire and Hertfordshire police forces have jointly received the Carer-Friendly Tick Award – Employers for their work in supporting employees who are unpaid carers. The accreditation runs until February 2026, after which the forces must submit further evidence to demonstrate their continued commitment to unpaid carers.

Snell & Wilmer Benefits

MAY 31, 2024

The increased catch-up contribution limit for eligible participants is the greater of: (a) $10,000, subject to cost-of-living adjustments starting in 2026; or (b) 150% of the limit in effect for 2024 (i.e., Employers may need to work with their payroll teams and update their existing processes (e.g., What is the increased limit?

Employee Benefits

FEBRUARY 5, 2024

Yet, at the same time, with money tight both for employers and employees, keeping driving and car costs down remains key. Here are some top tips on how employers can help employees better manage their company car costs. This will then change to 3% in 2025/26, 4% in 2026/27, and 5% in 2027/28.”

Employee Benefits

MARCH 7, 2024

This will include the impact of the 10% national living wage increase and enhancement of its pension benefits, with staff now able to access up to 6% employer contributions. The bakery chain also implemented an 8% overall wage and salary inflation in 2023 and expects to make around an increase of around 9.5%

Proskauer's Employee Benefits & Executive Compensa

AUGUST 28, 2023

requirement that catch-up contributions for participants with FICA wages of more than $145,000 during the prior calendar year from the employer maintaining the plan must be made on a Roth basis. On Friday, the IRS released Notice 2023-62 , which addresses certain pressing implementation issues related to the SECURE 2.0 Under SECURE 2.0,

HR Digest

OCTOBER 16, 2024

The minimum wage vote in California has been met with resistance from many who believe it would upset the balance of the economy and cause employers to cut down on the number of jobs they can offer, due to the higher expenses on wages. Employers with 25 employees or lower will be expected to pay workers $17 per hour. per hour in 2025.

cipHR

NOVEMBER 15, 2021

However, if they have any other form of income, get benefits-in-kind from their employer (health insurance, life insurance or a company vehicle etc) or claim tax relief for any other reason, it will affect this tax code. Some employers also top these payments up. Variable payments. Their NI letter is C. Pension payments.

Workplace Insight

MARCH 25, 2024

In comparison, just 19 percent of non-graduates plan to independently upskill and only 18 percent expect access to this through their employer between now and 2026. Just 19 percent of over 55’s are seeking AI training themselves over the next few years while only 18 percent are looking for this through their employers.

Snell & Wilmer Benefits

AUGUST 28, 2023

requires catch-up eligible participants who received more than $145,000 in wages from their employer in the prior year to make catch-up contributions on a Roth basis. Notice 2023-62 addresses these concerns by giving plan sponsors until January 1, 2026 to implement the SECURE 2.0 More specifically, SECURE 2.0 This SECURE 2.0

Employee Benefits

JULY 24, 2023

After a week of negotiations with the Advisory, Conciliation and Arbitration Service (Acas) the Aslef Executive Committee and trade union RMT agreed to suspend the planned industrial action on Wednesday 26 and Friday 28 July after receiving confirmation that there would be no change to the pension scheme until 2026.

Employee Benefits

MAY 2, 2024

Although the deadline for connecting is 31 October 2026, trustees and pension scheme providers are expected to aim to connect by the timetable outlined in the guidance rather than waiting until the strict legal deadline. If you would like to speak to Jonathan please do not hesitate to get in touch.

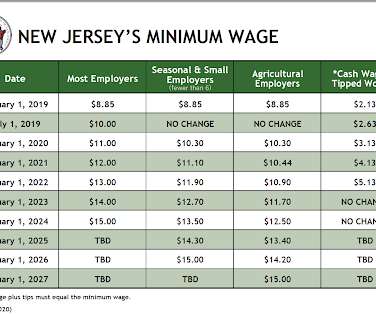

Workers' Compensation

DECEMBER 29, 2021

Under the law, seasonal and small employers were given until 2026 to reach $15 per hour to lessen the impact on their businesses. hour, with employers able to claim a $7.87 If the minimum cash wage plus an employee’s tips do not equal at least the state minimum wage, then the employer must pay the employee the difference.

Employee Benefits

JANUARY 21, 2022

As announced in April’s Budget, the Lifetime Allowance (LTA) will be frozen at its current level of £1,073,100 until April 2026. and receives employer contributions of 10%, it is possible for their pension fund to reach £1,381,000 by the time they retire at 65. Assumes growth rate of 5% and excludes charges on the pension plans.

Vantage Circle

APRIL 24, 2023

They can be sent instantly via email or other digital platforms, making them a convenient option for busy employers. Additionally, digital gifts can be easily customized to meet the needs and preferences of individual employees, allowing employers to tailor their gifts to each person's interests and tastes.

HR Digest

NOVEMBER 26, 2023

billion by 2026. billion by 2026. HR tech can be used to simplify existing responsibilities instead of the endless stacks of paperwork they are often left to deal with, saving time as well as reducing the likelihood of errors. Statista reports that the annual revenue of HR tech was around $62.6 The booming industry has a lot on offer.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content