Top 10 Employee Benefits Certifications for Professionals in 2024

HR Lineup

OCTOBER 21, 2024

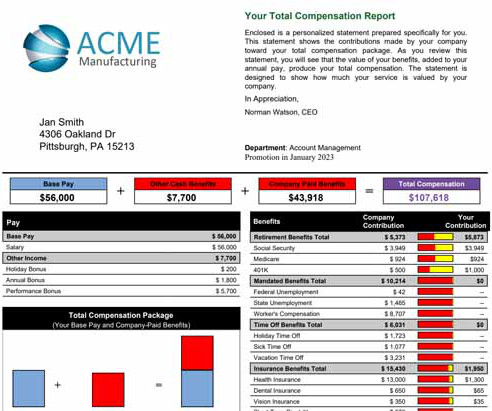

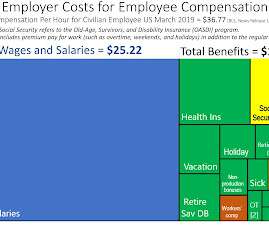

Best For: HR professionals who manage both employee compensation and benefits programs. Key Benefits: Specializes in 401(k) plan management, including plan design, fiduciary responsibility, and investment strategies. It’s ideal for professionals who want to specialize in retirement benefits and pensions.

Let's personalize your content