What's a good 401(k) employer match?

Employee Benefit News

SEPTEMBER 25, 2024

Most companies that offer to match employees' 401(k) contributions offer a match of between 3.00% and 4.99% of their employee's pay.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Employee Benefit News

SEPTEMBER 25, 2024

Most companies that offer to match employees' 401(k) contributions offer a match of between 3.00% and 4.99% of their employee's pay.

International Foundation of Employee Benefit Plans

DECEMBER 12, 2024

Many 401(k) plans allow participants to take out loans from their individual 401(k) account. According to Employee Benefits Survey: 2024 Results, 81% of corporate employer plans offered a 401(k) loan provision.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Understanding Group Medicare for an Aging Workforce: Key Considerations for HR Leaders

More Than a Benefit: Group Medicare and the Psychology of Retirement

Employee Benefit News

SEPTEMBER 23, 2022

(..)

HR Digest

NOVEMBER 7, 2024

The Internal Revenue Service is making some changes to how much you can contribute to your 401(k) plans. As per the IRS, 401(k) limits for 2025 have been increased to an annual amount of $23,500, up from $23,000. Will the 401(k) Cap Increase Be Enough to Help Employees Save for Retirement?

Employee Benefit News

MAY 11, 2023

(..)

HR Digest

OCTOBER 5, 2022

If you’re furloughed, does that mean your 401k is canceled? In a sentence: no, your furlough pay reduction does not lead to 401k cancellation. Your 401k is yours, and it stays yours. In this article, you should know that furlough and 401(k) are two different things. How is your 401(k) affected by furloughs?

HR Lineup

OCTOBER 25, 2023

One of the cornerstones of retirement planning is the 401(k) plan, and choosing the right provider can significantly impact your financial future. In this article, we’ll explore the top 10 401(k) providers for 2023, each offering unique features and benefits to help you make an informed decision. What is a 401(k)?

International Foundation of Employee Benefit Plans

SEPTEMBER 4, 2024

Many 401(k) plans allow participants to take out loans from their individual 401(k) account. According to Employee Benefits Survey: 2024 Survey Report, 81% of corporate employer plans offered a 401(k) loan provision.

Genesis HR Solutions

NOVEMBER 18, 2020

If you’re a small business owner interested in starting a 401(k) plan for your employees, you already understand how they will benefit, but you should also understand how the plan will affect you. Sometimes, the traditional 401(k) plan doesn’t end up providing you the full benefit you’d hoped for.

WEX Inc.

NOVEMBER 21, 2024

Employers leveraging data-driven platforms to offer customized options will stand out regarding employee recruitment and retention. Employers that empower employees to access and use benefits on their terms will likely see higher engagement and loyalty.

HR Digest

AUGUST 28, 2023

This mini-guide explores whether a solo 401k is a good idea for individuals like you. But how does a solo 401k work? And who qualifies for a solo 401k? And who qualifies for a solo 401k? What happens to solo 401k when you’re no longer self-employer? How Does a Solo 401k Work? No employees allowed!

Genesis HR Solutions

JANUARY 30, 2023

Should you auto-enroll your employees into your company’s 401(k) program? Automatic enrollment is exactly what it sounds like—you, the employer, automatically enroll your employees into your organization’s 401(k) plan. The 401(k) is pre-tax. What is automatic enrollment?

BerniePortal

JUNE 1, 2022

Many firms like Fidelity Investments have been willing to bet on Bitcoin and other alternative currencies—at least as an offering for 401(k) plans. Citing employer’s “fiduciary responsibilities” under ERISA, the DOL’s cautionary stance on crypto investments has been particularly strong.

HR Lineup

MARCH 10, 2022

Nonqualified deferred compensation (NQDC) plans are among the benefits employers use to retain top talent , and if you are wondering what they are, this article clarifies everything. A non-qualified deferred compensation (NQDC) plan is whereby an employer reaches an agreement with an employee to pay them sometime in the future.

HR Digest

FEBRUARY 13, 2022

To provide financial support, many employers think about 401K retirement plans a nd student loans. In the times when many employees leave their work, the employers need to think about financial benefits that can make people stay at work. .

International Foundation of Employee Benefit Plans

NOVEMBER 18, 2022

Court affirms judgment in favor of the defendant employer related to the award of 401(k) benefits to a former employee’s ex-husband. The post Legal & Legislative Reporter: Distribution of 401(k) Benefits to Ex-Husband appeared first on Word on Benefits.

WEX Inc.

JUNE 13, 2024

How is your HSA vs. your 401(k) vs. your IRA shaping up for retirement planning? To help you prepare, here is a breakdown of three common retirement accounts: an HSA vs. a 401(k) vs. an IRA. Employers can also contribute to their employees’ HSAs. Will you retire in Florida, or at a cabin in the woods?

Money Talk

JUNE 5, 2024

This includes understanding characteristics and amounts of different categories of investments including retirement savings plans like IRAs and 401(k)s. Three tips were provided: understand your retirement savings plan, automate your contributions, and learn about the tax benefits of IRAs and employer plan contributions.

Best Money Moves

DECEMBER 4, 2024

By learning the common financial challenges for each generation, employers can adopt impact-driven benefits designed to help alleviate all employees’ financial stress. Over 1 in 3 US employees wish their employer offered student loan financing and repayment assistance benefits, according to PNC’s report.

WEX Inc.

NOVEMBER 14, 2024

Health savings account An HSA is an individually owned benefits plan funded by you or your employer that lets you save on purchases of eligible expenses. Flexible spending account An FSA is an employer-owned account that you use to set aside funds for qualified expenses. Your employer owns your FSA.

Employee Benefit News

JANUARY 22, 2024

A new provision enables employers to contribute to a workplace 401(k) plan when an employee pays their student loan debt.

HR Lineup

MARCH 13, 2022

In a defined benefit plan, an employer pays a predetermined amount at either termination of employment or retirement. The employer breaks the sum into annual payments, which they deposit as savings to provide the benefits prescribed by the program’s terms. Nonetheless, some common examples include: 401(k).

InterWest Insurance Services

NOVEMBER 25, 2022

The changes, which the IRS releases in November each year, will affect contribution limits for HSAs, FSAs and 401(k) and other retirement accounts. Every year, the employee must decide how much they want their employer to deduct (pre-tax) from their paycheck to set aside in their HSA. 7,750 for family coverage (up $450).

Wellable

SEPTEMBER 11, 2023

How can employers help their workforce navigate modern retirement amid market volatility? The post Beyond The 401(k): The Full Potential Of Employee Financial Wellness appeared first on Wellable. 62% of workers see inflation as a barrier to securing their retirement.

Money Talk

APRIL 6, 2023

Below are my key take-aways: Reluctance to Spend - Many people who saved regularly for decades in retirement savings plans such as IRAs and 401(k)s- as financial experts told them to do- are now hesitant to spend down their assets. 401(k) plans), they generally don’t save for retirement.

Business Management Daily

FEBRUARY 23, 2022

Last year, the Department of Labor released a trio of documents advising employers with 401(k) plans about cybersecurity. The DOL is backing up the advice in those documents during plan audits by scrutinizing employers’ and third parties’ cybersecurity efforts.

BerniePortal

OCTOBER 26, 2020

In October 2020, the IRS announced key updates to 401(k) contribution limits for 2021, including changes to catch-up contributions and employer contributions. Here’s what HR needs to know about this announcement.

HR Digest

NOVEMBER 1, 2024

Most employees work with multiple employers over the course of their career but even moderate instances of job hopping can have a lasting impact on their retirement fund. workers typically work with nine different employers over their careers. According to Vanguard , U.S.

Patriot Software

JANUARY 25, 2021

As an employer, you can offer small business retirement options, like 401(k) plans, to your employees. But when it comes to 401(k) options, it isn’t just a one and done type of deal. There are a few different types of 401(k) plans to choose from.

Proskauer's Employee Benefits & Executive Compensa

DECEMBER 7, 2023

The day after Thanksgiving, while many of us were fortunate enough to be reaching for leftover pie, the IRS released proposed regulations implementing the requirement that 401(k) plan sponsors permit “long-term part-time employees” to make elective contributions to a 401(k) plan. Who is a long-term part-time employee?

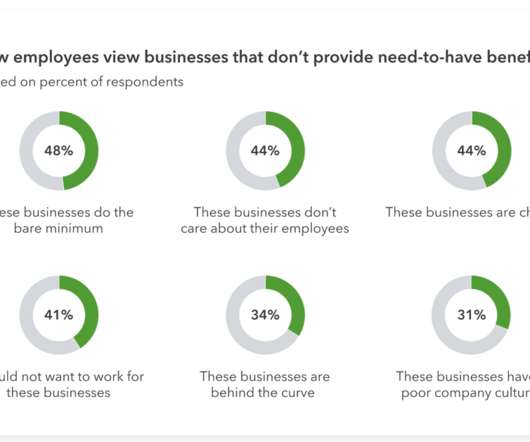

Achievers

APRIL 4, 2022

Your organization’s employer brand should always be top of mind. Let’s take a closer look at what employer branding is and what your company can do to organically build an employer brand that sets it up for success. What is employer branding? Your company’s employer brand is then how these individuals perceive it.

HR Digest

OCTOBER 4, 2024

These roles are often treated as temporary sources of employment and largely insufficient to sustain a family. Along with Hobby Lobby’s current wage hike, the shopping chain also provides other fiscal and medical benefits like a medical and dental plan, 401(k) with generous company match, a flexible spending plan, life insurance, etc.

Money Talk

APRIL 20, 2023

One of my Money Talk clients is my long-time employer, Rutgers Cooperative Extension. Off-Farm Job Employer Benefits - These include a defined benefit pension, an employer retirement savings plan (e.g., 401(k), 403(b), 457 plan, and thrift savings plan), and other employer benefits (e.g., health insurance).

InterWest Insurance Services

JANUARY 17, 2023

Besides health insurance and a 401(k) plan, other benefits that employees value highly are generous paid time off and flexible or remote work, according to a new survey. Sixty-four percent of employees surveyed said they do not have access to an emergency savings option through their employer.

Money Talk

AUGUST 31, 2023

pension, Social Security, annuities, dividends/capital gains, full- or part -time employment, self-employment) minus fixed (e.g., America’s 401(k) Experiment - 2023 is the 45 th anniversary of tax-deferred 401(k) retirement savings plans that workers fund with voluntary contributions from their pay.

Money Talk

JANUARY 18, 2023

Increased Savings Contribution Limits - Maximum limits for employer retirement plans (e.g., 401(k)s) and IRAs are pegged to inflation. This pay increase may or may not cover all of their increased expenses, but it is better than no increase. When inflation rises, workers can save more money.

HR Digest

MARCH 28, 2023

One popular way to get your retirement plan sorted in the United States is through a 401(k) plan. A 401(k) plan is a type of retirement account offered by employers to their employees. How does 401(k) work? A 401(k) plan is that the money grows tax-free until it is withdrawn at retirement age.

Achievers

DECEMBER 16, 2019

Then, with a twinge of foreboding, “That’s as long as their current employer offered a better benefits package.”. A matching 401(k) or pension. Often, the line between how people think of you as a provider of products or services and how they think of you as an employer is blurred. Health insurance. Use of a company car.

Money Talk

JUNE 16, 2022

Examples include a 401(k) or 403(b) plan and traditional IRA. Does your employer offer matching retirement contributions? Required Minimum Distributions (RMDs)- RMDs must begin at age 72 for traditional IRAs, employer retirement accounts, and SEPs (for self-employed workers). How many years do you have before retirement?

Money Talk

APRIL 11, 2024

Baby Boomer Challenges - Baby boomers (born 1946-1964) were the first generation with the ability to save money for retirement in 403(b)s, 401(k)s, and IRAs for decades (their parent’s generation had pensions). 401(k), 403(b), 457, or Thrift Savings Plan). Many have accumulated significant sums and need tax planning help.

Employee Benefit News

JULY 10, 2024

Providing truly equitable benefits can be measured by discovering that two similarly situated employees classified differently have equitable outcomes.

Money Talk

MAY 18, 2022

Ramp Up Retirement Savings - Consider increasing retirement savings in a tax-deferred employer retirement savings plan (e.g., 401(k), 403(b), and traditional IRA). . ¨ Set Up Spreadsheets - Taxpayers with recurring income and/or expenses (freelancers, landlords, Airbnb and VRBO hosts, employees with side hustles, etc.)

HR Lineup

FEBRUARY 8, 2022

As an employer or business owner, there are various taxes that the federal and state government requires you to pay. With the W-2, employers will also contribute a share of those taxes. Keep in mind that earnings exceeding $7,000 are not taxed, and it is the employer who pays this tax and not employees. . of the SUTA tax rate.

Proskauer's Employee Benefits & Executive Compensa

JANUARY 16, 2024

Although Notice 2024-02 offers helpful guidance for employers and plan administrators, it does not include hotly anticipated guidance on SECURE 2.0 requires that 401(k) plans established after December 28, 2022, implement automatic enrollment provisions for plan years starting after December 31, 2024. Merger of Pre-SECURE 2.0

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content