Learn from payroll year-end mistakes or repeat them

Business Management Daily

NOVEMBER 12, 2019

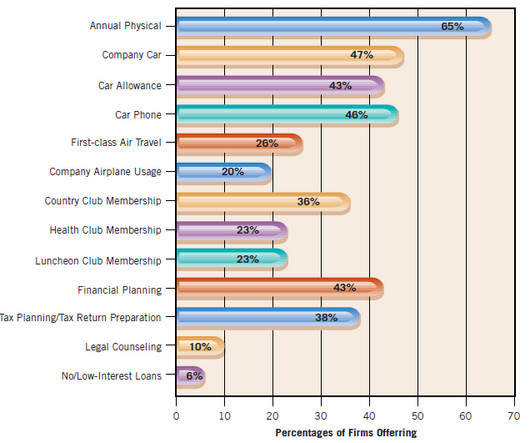

According to our tally, you’ll probably be crossing paths with Accounts Payable, Benefits, HR and the executive compensation committee. Executive compensation committee: 20% excise tax on golden parachute payments, income from the exercise of nonstatutory stock options and nonqualified deferred compensation.

Let's personalize your content