The Ultimate Guide to Total Compensation Statements: Maximizing Employee Understanding and Satisfaction

COMPackage

JULY 2, 2024

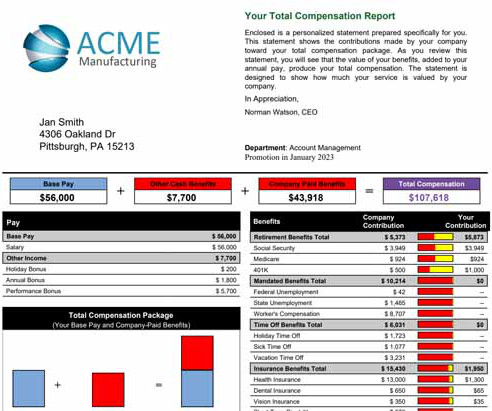

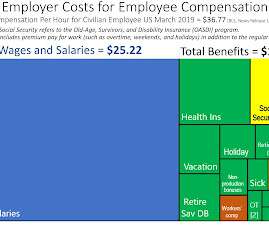

Bonuses and Incentives : Performance-related pay, including annual bonuses, commissions, and profit-sharing. Key Components of an Effective Total Compensation Statement To create an effective Total Compensation Statement, it’s essential to include several key components: 1. Ensure that the data is accurate and up-to-date.

Let's personalize your content