Types of Compensation: Everything HR Needs to Know

HR Lineup

FEBRUARY 1, 2024

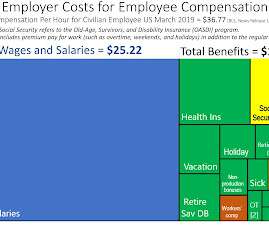

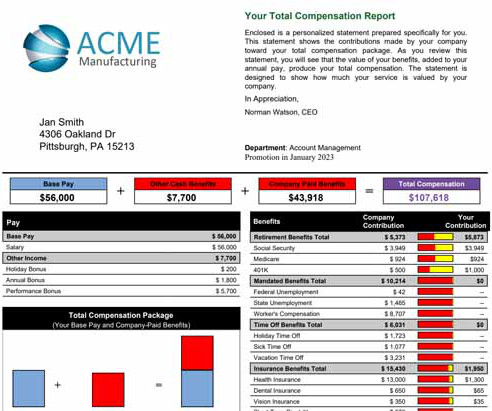

In the dynamic landscape of human resources, managing compensation is a crucial aspect that directly impacts an organization’s ability to attract, retain, and motivate employees. Compensation goes beyond just the salary paid to employees and includes various elements designed to reward and recognize their contributions.

Let's personalize your content