How to Cut Health Care Costs

Money Talk

DECEMBER 16, 2021

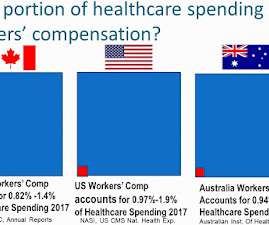

One category is health care, which takes a big chunk out of family budgets. This includes expenses for health insurance as well as deductibles, copayments, and coinsurance when medical bills occur. In 2018, the average American household spent almost $5,000 per person on health care. .

Let's personalize your content