Is your small business eligible for the Employee Retention Tax Credit?

Employee Benefit News

MARCH 28, 2023

(..)

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Employee Benefit News

MARCH 28, 2023

(..)

HR Lineup

SEPTEMBER 24, 2024

The objective of HTR is to create a seamless experience for employees while optimizing workforce management and enhancing organizational efficiency. Employee Retention and Loyalty HTR emphasizes employee engagement, recognition, and development—all factors that contribute to higher retention rates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Understanding Group Medicare for an Aging Workforce: Key Considerations for HR Leaders

More Than a Benefit: Group Medicare and the Psychology of Retirement

HR Lineup

MARCH 23, 2025

For example, AI-driven chatbots can handle common employee queries about leave policies or benefits, reducing the workload for HR personnel while ensuring quick responses. Improved Compliance and Risk Management Compliance with labor laws, tax regulations, and company policies is a significant challenge for HR teams.

COMPackage

FEBRUARY 25, 2025

Incentive and welfare program for employee retention, building staffs loyalty reduce resignation rate for important talent, boss holding magnet to pull back resigned or leaving employee. In 2025, employee retention continues to be one of the most pressing challenges for organizations across industries.

HR Lineup

SEPTEMBER 28, 2024

Core Functions of HRIS: Employee Data Management: Manages employee profiles, including personal information, job titles, and contact details. Payroll and Compensation Management: Automates payroll processing , salary adjustments, and tax calculations. Time and Attendance: Records work hours, leave balances, and overtime.

WEX Inc.

JULY 30, 2024

Keep the conversation focused on the value benefits have on your company, including: Employee retention Attraction of more talent Health/medical coverage is necessary Employee work/life balance Show proof of benefits plan success After presenting your information, the conversation can go many ways. It is not legal or tax advice.

McDermott Will & Emery Employee Benefits

OCTOBER 17, 2024

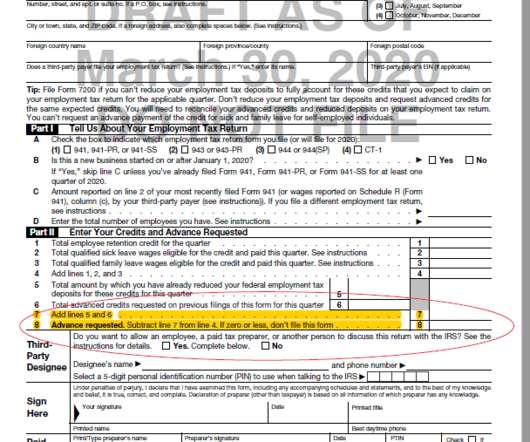

The Internal Revenue Service (IRS) introduced a supplemental claim process to assist payroll companies and third-party payers in resolving incorrect claims for the Employee Retention Credit. This process allows third-party payers to correct or withdraw claims for taxpayers who are ineligible for the credit.

Employee Benefits

FEBRUARY 26, 2024

Employee retention is an ongoing theme for employers and HR professionals, and for good reason. It’s more cost-effective to invest in employee retention strategies than it is to attract, onboard and train new starts. Are you at high risk of high employee turnover? Creating an enviable company culture Values matter.

BerniePortal

AUGUST 31, 2021

The Employee Retention Credit is one provision of early COVID stimulus that has been extended and expanded as the pandemic has evolved. Recently, the IRS issued additional guidance to help financially distressed employers take advantage of this tax credit in Q3 and Q4.

Business Management Daily

DECEMBER 15, 2021

The employee retention credit expired retroactively and earlier than many employers had anticipated—at the end of the third quarter, instead of the end of the fourth quarter. For tax deposits due by Dec. For tax deposits due by Dec. For Friday paydays, tax deposits are due by the next Wednesday—Jan. 31 is a Friday.

Business Management Daily

DECEMBER 6, 2021

Employee retention is a major challenge for employers at this time. Employees largely put off changing jobs during the pandemic due to the level of instability in the labor market. To combat turnover, it’s time to take a more active approach in retaining employees and boosting engagement. Allow telecommuting.

HR Digest

MARCH 12, 2025

This article unpacks the fringe benefits definition, explores their types and examples, and offers a clear overviewincluding tax implications and practical guidance for employers navigating the IRS fringe benefits guide. In 2025, theyre a cornerstone of progressive HR policies, reflecting a shift toward holistic employee value propositions.

Patriot Software

APRIL 8, 2020

One of the coronavirus small business relief measures comes in the form of employer tax credits. There are two groups of refundable coronavirus tax credits available for employers: 1) COVID-19-related tax credits for paid leave and 2) Employee Retention Credit.

Employee Benefit News

APRIL 23, 2024

Parents of school-aged children need help with child care in order to give their best at work.

HR Digest

JUNE 23, 2023

Imagine a scenario where you are rewarded with a hefty sum of $26,000 per employee, just by gathering some data and filling out a tax form. Well, this isn’t a fantasy, it’s the reality of the Employee Retention Tax Credit (ERC). Your ERC Tax Credit is on its way! Sounds like a dream, right?

HR Lineup

APRIL 19, 2024

This can take various forms, including stock options, restricted stock units (RSUs), stock appreciation rights (SARs), and employee stock purchase plans (ESPPs). In this comprehensive guide, we will delve into the various types of equity compensation, how they work, their tax implications, and their impact on both employees and employers.

Achievers

NOVEMBER 1, 2016

Furthermore, this cost estimate is only an average; replacing more specialized employees can often run into six figures! One-third of all employees know within the first week at a new job whether they will stay with the company for the long term. Make room for personal work styles.

Patriot Software

MAY 12, 2020

Due to the coronavirus negatively affecting businesses nationwide, there are a number of coronavirus payroll tax credits available to help employers out. One option for employers is the Employee Retention Credit (ERC). The post What Is the Employee Retention Credit, and How Does It Work for Employers?

HR Lineup

AUGUST 6, 2024

ADP Workforce Now ADP Workforce Now is an all-in-one HR management platform that caters to mid-sized businesses, offering a range of tools to manage the employee lifecycle efficiently. Payroll and Tax: Integrated payroll and tax filing services. Time and Attendance: Accurate tracking of employee hours and attendance.

Patriot Software

FEBRUARY 8, 2023

Think it’s too late to take advantage of the Employee Retention Credit? And, what are the steps for claiming Employee Retention Credit retroactively? Think again. Employers now have until 2024 (and in some cases, 2025) to claim the credit retroactively. So, how do you know if you qualify for the credit?

HR Bartender

FEBRUARY 22, 2022

Ensuring employees are paid in a secure, efficient, and timely manner is one of the fundamental roles of an employer. That includes compliance with employment tax payment and reporting rules with each of the various local, state, and federal agencies to avoid penalties. 3 – Reducing Risk Exposure. Garnishments impact 1 in 14 U.S.

HR Lineup

MAY 24, 2022

The volunteer time off policy will attract community-minded and value-driven employees without you investing so much into the hiring process. Employee Retention. Such employees experience less stress and feel comfortable about themselves. What exactly do your employee volunteers do? Describe The Volunteer Work.

WEX Inc.

OCTOBER 15, 2024

For employers, brokers, and other partners: Not only do employers play an essential role in educating employees on how to use their HSAs effectively, from tax advantages to investment opportunities, but employers can also benefit directly from the deployment of HSAs. Employers’ contributions to employees’ HSAs are tax deductible.

Kollath CPA

APRIL 20, 2023

The federal government’s Employee Retention Credit proved to be a lifeline for many businesses and their employees. Even though the program has ended, employers are still able to file for tax relief retroactively. Even though the program has ended, employers are still able to file for tax relief retroactively.

Kollath CPA

APRIL 20, 2023

The federal government’s Employee Retention Credit proved to be a lifeline for many businesses and their employees. Even though the program has ended, employers are still able to file for tax relief retroactively. Even though the program has ended, employers are still able to file for tax relief retroactively.

Business Management Daily

MAY 13, 2020

Getting a Paycheck Protection Program loan was fraught, limited to employers with fewer than 500 employees, and only covered eight weeks of payroll and expenses. The employee retention credit, on the other hand, comes with fewer strings and is easier to claim, since you account for it on your 941. Corporate tax impacts.

McDermott Will & Emery Employee Benefits

NOVEMBER 9, 2023

Asserting that many employers have improperly claimed Employee Retention Tax Credit (ERTC) refunds, the Internal Revenue Service (IRS) released two new announcements that address ERTC claims.

McDermott Will & Emery Employee Benefits

SEPTEMBER 10, 2024

On August 15, 2024, the Internal Revenue Service (IRS) released Announcement 2024-30, which provides a second Employee Retention Credit Voluntary Disclosure Program for employers to resolve erroneous claims. This program aims to help employers avoid civil litigation, penalties, and interest by settling their civil tax liabilities.

HR Lineup

APRIL 17, 2023

Secondly, jury duty can be a stressful and emotionally taxing experience. Employers who provide employees with time off to serve on a jury help alleviate this stress and promote the well-being of their employees. Thirdly, denying employees time off for jury duty can lead to legal complications and negative publicity.

WEX Inc.

AUGUST 6, 2024

Encourage employee feedback and engagement to continually refine and improve the EVP. By analyzing employee retention, it is possible to see direct effects of your EVP! It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

Business Management Daily

AUGUST 19, 2021

If Congress had stuck to the original Paycheck Protection Plan (PPP) rules — holders of loans forgiven under the Paycheck Protection Program couldn’t also take the employee retention credit — we wouldn’t find ourselves with the problem we have today. But Congress didn’t. This, in turn, has opened up yet another can of worms.

Insperity

OCTOBER 2, 2018

When federal tax reform happens, it makes headlines across all media, with the news of sweeping tax changes and how they impact businesses and individuals. Our nation’s first major tax reform in more than 30 years has spurred many business owners to spend hours with their CPAs and tax consultants over the past few months.

Business Management Daily

MAY 20, 2020

No one ever said the paycheck protection program loans and the employee retention credit would be easy to implement. Employee retention credit. Either the IRS will update its FAQ or new legislation will conform to the tax writers’ intent. share of Social Security taxes through the end of the year.

Proskauer's Employee Benefits & Executive Compensa

FEBRUARY 18, 2022

In this episode of The Proskauer Benefits Brief, Proskauer partner David Teigman , senior counsel Nick LaSpina , and special guest Michelle Garrett , a principal at the compensation consulting firm Semler Brossy, discuss employee retention. David Teigman: Today, I wanted to talk about employee retention.

Patriot Software

DECEMBER 20, 2021

The November 2021 Infrastructure Investment and Jobs Act ended the Employee Retention Credit (ERC) program earlier than expected. Originally slated to expire December 31, 2021, the ERC ended retroactively for most businesses on September 30, 2021. IRS Notice 2021-65 answers those questions.

Achievers

APRIL 24, 2018

Employee retention. The act of praising and incentivizing employees who perform well or provide value to the company is critical—but you don’t have to break the bank with bonus checks that are taxed at an extremely high rate. A strong company culture improves: Identity of the organization. Corporate image.

Empuls

MARCH 23, 2023

At a time when the world was grappling with a health crisis, what could an employee retention tax credit have done? The earlier underestimated lifeline, thrown toward small businesses and employees made a difference in how employees and employers handled the Covid-19 wave. What is the employee retention tax credit?

Snell & Wilmer Benefits

JANUARY 26, 2024

Lowry The IRS continues to evaluate and process Employee Retention Credit (“ERC”) claims with a focus on inaccurate and ineligible filings. The short-duration relief, known as the Employee Retention Credit Voluntary Disclosure Program (“ERC-VDP”), will run until March 22, 2024.

HR Lineup

JULY 4, 2022

They will send the new hires pre-boarding documents, including tax forms, to enable them to read and sign once they fully understand. A good pre-onboarding engagement will help you rate your employee value proposition and empowerment to create an outstanding workforce that embraces teamwork.

HR Lineup

FEBRUARY 9, 2024

Accurate and efficient payroll processing ensures that employees are compensated correctly and on time, while also helping businesses comply with various regulations and tax requirements. Maintain Accurate Employee Records Accurate employee records are the foundation of effective payroll tracking.

HR Lineup

OCTOBER 18, 2023

They ensure that your company remains in full legal compliance with payroll, benefits, taxes, and more in over 150 countries, eliminating the potential for costly errors and legal repercussions. Seamless Onboarding: The company offers a streamlined onboarding process that allows businesses to hire remote talent swiftly and efficiently.

Business Management Daily

APRIL 1, 2020

Quick as jackrabbit, the IRS has released a new draft form and draft instructions for employers that elect to take any of the payroll tax credits contained in the Families First Coronavirus Response Act and the Coronavirus Aid, Relief, and Economic Security Act. MediumCo pays $10,000 in sick leave and is required to deposit $8,000 in taxes.

PeopleStrategy

APRIL 18, 2022

If you are running your own small business, then chances are that taxes are one your biggest expenses. Although having a good tax plan is place is an effective strategy, you can save more money for your business with our small business tax tips. Here are some useful ideas that can help you reduce your business taxes in 2022.

Business Management Daily

AUGUST 2, 2023

mail for their own nefarious purposes, the main avenues for tax scams remain email and text messaging—these methods reach many more people at a fraction of the cost of a stamp. It would be good to inform employees about these scams. We are writing to inform you abount an important matter regarding your recent tax return filing.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content