3 Reasons to Boost Your Employee Benefits Offerings in 2020

Achievers

DECEMBER 16, 2019

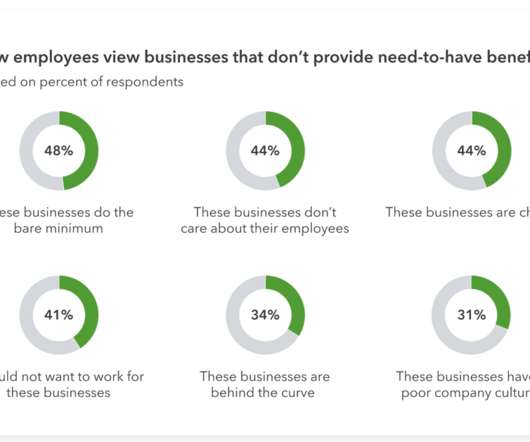

If that’s the case, it’s no wonder even seasoned employees are entertaining a change of professional scenery. Health insurance. A matching 401(k) or pension. Twenty-nine percent of respondents in the employee benefits survey said their company provided “the bare minimum.” Consider the benefits you offer currently.

Let's personalize your content