Ten Benefits of Self-Employment in Later Life

Money Talk

OCTOBER 11, 2023

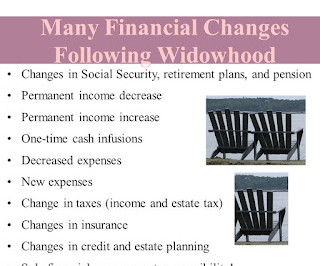

Net business earnings can pay living expenses or provide cash for “extras” such as travel and entertainment and home upgrades. Tax Write Off for Health Insurance - On line 17 of Schedule 2, self-employed workers can take an “above the line” deduction for health insurance, which lowers their AGI.

Let's personalize your content