Practical Considerations for New Pay vs. Performance Disclosure Requirement

Proskauer's Employee Benefits & Executive Compensa

SEPTEMBER 22, 2022

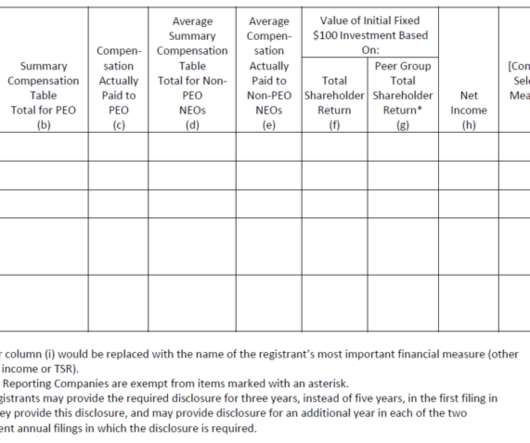

The SEC’s final rule on Pay Versus Performance becomes effective on October 8, 2022, and will require new executive compensation disclosures for the upcoming proxy season (for annual proxy statements that include executive compensation disclosure for fiscal years ending on or after December 16, 2022).

Let's personalize your content