Emissions tied to asset owners' financing activities fall for first time

Employee Benefit News

OCTOBER 18, 2023

The decline was mainly driven by the pension funds and insurance companies' push to persuade companies to develop transition plans.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Employee Benefit News

OCTOBER 18, 2023

The decline was mainly driven by the pension funds and insurance companies' push to persuade companies to develop transition plans.

HR Lineup

OCTOBER 13, 2024

Key Services: Talent and Reward Consulting Employee Benefits and Risk Management HR Technology Implementation Retirement and Pension Plan Consulting Talent Analytics and Workforce Planning Why It Stands Out WTW is known for its robust talent analytics and data-driven HR solutions. Headquartered in London, WTW operates in over 140 countries.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Employee Benefits

FEBRUARY 7, 2023

The financial wellbeing provider’s whitepaper ‘Unlocking the pay cycle’ was authored by its head of impact and inclusion Emily Trant, with advisory input from Resolution Foundation, Money and Pensions Service, Nest Insight, RideTandem and the University of California, Berkeley.

Money Talk

MAY 31, 2023

The dominant voices in personal finance advocacy are white, male, and middle class with privilege. Financial Education - Personal finances classes can be a “great equalizer” for income and asset disparities and should be available everywhere and not by ZIP code. It can completely change a student’s life. Financial knowledge is power.

Take It Personel-ly

JUNE 10, 2021

Pensions are something that many people don’t start to think about until it’s too late. But starting to save for your pension sooner rather than later will save you a headache […]. After all, most of us have more immediate things to be saving for, whether that’s a home, a car, or an unexpected boiler repair.

Money Talk

MARCH 24, 2022

I recently taught a 90-minute personal finance class for women age 50+. Sources of Retirement Income - Income sources include Social Security, employer defined-benefit pensions or defined-contribution retirement plans (e.g., 401(k)s), tax-deferred accounts (e.g., IRAs), taxable accounts, rental real estate, other assets (e.g.,

Employee Benefits

NOVEMBER 15, 2023

Need to know: Employers can tailor content and communication channels to different employee groups to help with their pensions knowledge. Losing the jargon will make the language of pensions easier to understand and more relevant to staff. They could invest in financial coaching for a more personal approach to pensions education.

Employee Benefits

NOVEMBER 15, 2023

So far, it has been delivered to approximately 80,000 of its UK employees. Kerry Shiels, pension and benefits director at BT, says: “It is very important that employees understand their BT pension and the retirement decisions they will need to make in the lead up to, and at, retirement.

Employee Benefits

JANUARY 18, 2023

One effective way in which employers can help drive employee engagement with pensions is by ensuring ease of access, so they can engage more easily and more regularly. In order to minimise jargon surrounding pensions, communication strategies should be easy to understand, inspiring, engaging and informing.

Money Talk

APRIL 12, 2023

It includes lying about finances and debt and hiding purchases. Placing every dollar of retirement savings in tax-deferred plans can be expensive in later life as RMDs get added to other ordinary income sources such as W-2 income from a job, a pension, Social Security, interest and dividends, mutual fund capital gains distributions, and more.

Money Talk

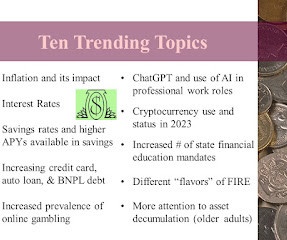

MAY 4, 2023

This means that more young adults will enter college, careers, or the military with personal finance knowledge. More Attention to Asset Decumulation - Baby boomers were “guinea pigs” for voluntary self-directed retirement savings accounts and the decline of pensions.

Money Talk

APRIL 20, 2023

Off-Farm Job Employer Benefits - These include a defined benefit pension, an employer retirement savings plan (e.g., Simplified Employee Pension (SEP)- This is a retirement savings plan for self-employed workers and small business owners. 401(k), 403(b), 457 plan, and thrift savings plan), and other employer benefits (e.g.,

Employee Benefits

OCTOBER 23, 2023

lost pension pots in the UK, worth around £26.6 billion WEALTH at work explains how employees can track down lost pensions and provides guidance on whether to consolidate The total value of lost pension pots has grown from £19.4 million lost pension pots sitting unclaimed because they’ve been simply lost or forgotten about.

Money Talk

DECEMBER 22, 2021

Pension COLAs - Pension benefits for some retirees are also indexed for inflation. An example is pensions for federal government workers and military retirees and disabled veterans. Other pensions have frozen or suspended COLAs for their retirees (e.g., the New Jersey state pension plan).

Employee Benefits

JANUARY 17, 2023

With increasing costs continually putting pressure on household finances, 2023 is set to be a financially challenging year for many. It’s therefore now more important than ever to support employees to take control of their finances to successfully navigate the cost-of-living crisis. Track your finances. Create a budget.

Employee Benefits

DECEMBER 1, 2023

Two-thirds (66%) of full-time UK employees regard contributory pensions and savings as important, according to research by Employee Benefits Isle of Man. Michael Crowe, chief executive at Finance Isle of Man, said: “What stands out clearly is that a one size-fits-all approach is increasingly obsolete in today’s diverse global workforce.

cipHR

JANUARY 11, 2022

The new year brings a new start for people’s finances, giving you the chance to re-evaluate your situation and make changes based on your priorities. This could begin with making a plan to pay off any outstanding debts that have been causing stress, or just being aware of changes that may impact your finances.

Money Talk

JUNE 8, 2022

Many older adults also have multiple income sources including Social Security, a pension, full-or part-time work or self-employment, withdrawals from retirement savings (including taxable required minimum distributions or RMDs), and interest, dividends, and capital gains on investments. In other instances (e.g.,

Money Talk

SEPTEMBER 30, 2022

Many events can affect IRMA including marriage, divorce, death of a spouse, taxable pensions, leaving the workforce, capital gains on the sale of assets, and the start of RMDs. A letter from the Social Security Administration (SSA) notifies beneficiaries of their expected benefit, including IRMAA deductions, if any. On the contrary.

Employee Benefits

SEPTEMBER 2, 2024

Choosing a pension provider that offers easily accessible and age appropriate investment education can increase employees’ confidence on the topic. In its March 2024 report, the Pensions and Lifetime Savings Association (PSLA) revealed that while 82% of savers understand their pension is invested, only 26% know what it is invested in.

Money Talk

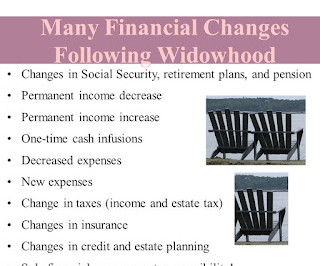

SEPTEMBER 12, 2024

A married couple has four monthly income streams: $2,500- husband’s pension, $2,000- husband’s Social Security, $800- wife’s pension, and $1,500- wife’s Social Security for a total of $6,800 ($81,600 annually). The wife’s pension and Social Security would go away, however, which could still result in a decrease in household income.

Money Talk

JUNE 16, 2022

If you picture retirement planning and taxes as a Venn Diagram, there is lots of overlap between these two areas of personal finance. Through Retirement” Planning ¨ Taxable Income Sources- Common types of taxable income in later life include pensions, distributions from workplace retirement accounts, and Social Security.

Employee Benefits

DECEMBER 19, 2023

It’s now more important than ever to support employees to take control of their finances. Create a budget – The first step to taking control of your finances is to create a budget. Start saving early – Starting to save when you are younger into ISAs and a pension means that the money has lots of time to grow.

Money Talk

MARCH 15, 2023

They are often bought with money from settlements, investment accounts, and pension plan lump sum distributions. This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation. Generally, variable annuities have the highest fees.

Employee Benefits

JULY 17, 2023

As a voluntary savings target, the living pension initiative sets out the minimum annual contribution needed to afford basic living costs in retirement. Organisations should engage employees in their future finances by introducing schemes to improve financial literacy and provide better pensions information.

Money Talk

NOVEMBER 9, 2023

Pension Payment Sequencing - Taxpayers fortunate to have a pension may want to delay their work exit date/pension start date to do Roth conversions or realize capital gains on taxable accounts before RMDs begin. Individuals must “do the math” to see if this strategy will work.

Money Talk

MAY 18, 2022

2021) or 90% of current year (2022) tax liability using a W-4 form at work for job-related income tax withholding; withholding for Social Security, a pension, and required minimum distributions through account custodians; and/or quarterly estimated payments using IRS Form 1040-ES.

Employee Benefits

JUNE 26, 2023

With interest rates on the rise, we often get asked at our financial education sessions, is it best to pay off your mortgage or pay into your pension? He concludes, “Many employers offer financial education in the workplace, to help their staff to understand their finances so they are better prepared to make decisions like these.”

Money Talk

JULY 25, 2024

It is also easier to keep personal and business finances separate by maintaining dedicated bank accounts and credit cards for business transactions. Stick to a Schedule - Invoicing clients promptly and following up on overdue payments can maintain healthy cash flow and avoid disruptions to personal finances.

Employee Benefits

MARCH 6, 2024

WEALTH at work, a leading financial wellbeing and retirement specialist has run financial education workshops for staff in hundreds of organisations and is encouraging people to consider using this saving in National Insurance if they can, to increase their monthly pension contributions. When made into a pension contribution it is worth £206.39

Money Talk

JANUARY 18, 2023

This includes Social Security recipients, retirees with COLA-adjusted pensions, and workers with COLAs stipulated in their job or union contracts. This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation.

Employee Benefits

JANUARY 19, 2023

As the cost of living crisis continues, it is now more important than ever that new parents understand how their finances will be affected and what actions they can take. WEALTH at work, a leading financial wellbeing and retirement specialist, highlights some top tips to help new parents stay in control of their finances: 1.

Employee Benefits

JULY 25, 2023

Transitioning to a superior provider is no longer a hassle: If you’re contemplating changing your current workplace pension scheme, the process isn’t as challenging as you might think. Many pension companies (we’re one of them!) What is a workplace pension? are prepared to assist you with the heavy lifting.

Money Talk

JULY 29, 2022

bank and investment accounts, pension, Social Security) should have a two-factor (a.k.a., This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation.

Employee Benefits

MARCH 13, 2023

In October 2022, professional services firm Deloitte introduced a flexible pension policy that gave its 22,000 UK employees more control over their finances, while still centring the importance of retirement savings. We deliberately structured the new policy to be more pro pensions than it was.

Employee Benefits

MAY 4, 2023

A quarter (26%) of large employers have seen an increase in the number of pension scheme opt-outs among employees in the face of the cost-of-living crisis , according to research by Cushon. The majority (84%) of those with a workplace pension agreed that increased financial education around pensions would be helpful.

Money Talk

FEBRUARY 1, 2024

Backstops Can Mitigate Risk-Taking - Some investors feel that they can take on more investment risk when they have a guaranteed source of income (think tenured educators or retirees with a pension and/or annuities). A good rule to follow to build financial knowledge is to learn one new thing every day about personal finance (e.g.,

Money Talk

AUGUST 30, 2022

a pension and Social Security). This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation. The amount of savings placed in an annuity should support longevity goals beyond other reliable income streams (e.g.,

Money Talk

OCTOBER 11, 2023

Back-Up Income - When older adults start a business, they often have back-up income sources such as Social Security, a pension, or an annuity. This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation.

Employee Benefits

MAY 2, 2024

The government has published statutory guidance setting out the staged timetable by which it expects pension schemes to connect to the Pensions Dashboards. With the launch of the Pensions Dashboards approaching there is potential to develop this into ‘Open Finance’ which is an extension of Open Banking.

Employee Benefits

APRIL 28, 2023

Cornish charitable housing association Coastline Housing has received living pension accreditation from the Living Wage Foundation. Launched last month , the living pension is a voluntary savings target for employers who want to help workers build up a pension that will provide enough income for everyday needs in retirement.

Money Talk

JANUARY 19, 2022

For example, workers with a guaranteed pension and/or a high investment risk tolerance might want to have more stock exposure in a TDF and would chose a target date farther off in the future. from a pension or annuity) is associated with increased financial satisfaction vs. simply having a lump sum to manage.

Money Talk

AUGUST 10, 2022

pension, Social Security, annuities, required minimum distributions) may necessitate adjustments in tax withholding or quarterly estimated tax payments. This post provides general personal finance or consumer decision-making information and does not address all the variables that apply to an individual’s unique situation.

Money Talk

AUGUST 31, 2023

pension, Social Security, annuities, dividends/capital gains, full- or part -time employment, self-employment) minus fixed (e.g., Baby Boomers were “guinea pigs” for the use of 401(k)s, often as a substitute for defined benefit pensions. rent and car payments), variable (e.g., gas, food, and gifts), and occasional (e.g.,

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content