PayrollOrg Comments on IRS Employment Tax Forms

PayrollOrg

OCTOBER 17, 2023

PayrollOrg’s Government Relations Task Force commented on the IRS’s information collection notice on federal employment tax forms in September.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

PayrollOrg

OCTOBER 17, 2023

PayrollOrg’s Government Relations Task Force commented on the IRS’s information collection notice on federal employment tax forms in September.

HR Digest

MARCH 15, 2025

Weve watched the buzz around the “No Tax on Overtime Bill” grow louder in 2025. The question on everyones mind is: When does the No Tax on Overtime Bill pass in 2025? The question on everyones mind is: When does the No Tax on Overtime Bill pass in 2025? No catch, its free from federal income tax.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

HR Lineup

FEBRUARY 8, 2022

As an employer or business owner, there are various taxes that the federal and state government requires you to pay. For instance, the W-2 employee (FICA) tax requires you to withhold your workers’ money to cater for medicare and social security taxes. With the W-2, employers will also contribute a share of those taxes.

HR Digest

MARCH 1, 2025

The idea of no tax on overtime has brought relief among workers who clock beyond the standard 40-hour work week. It comes as a golden opportunity to keep every hard-earned penny without the federal government taking a slice. So, when does the no tax on overtime start? When does no tax on overtime start? Lets dive in.

PayrollOrg

JANUARY 17, 2022

Federal Payroll Tax Laws & Regulations. Federal Payroll Tax Laws & Regulations contains payroll-related sections of the Internal Revenue Code and Internal Revenue Service regulations. Federal Payroll Non-Tax Laws & Regulations. APAs Guide to Local Payroll Taxes. Content is updated on a regular basis.

Employee Benefit News

JUNE 10, 2024

Without government intervention, it's estimated that Medicare funds will run out by 2036.

Money Talk

JUNE 16, 2022

If you picture retirement planning and taxes as a Venn Diagram, there is lots of overlap between these two areas of personal finance. This is true both during one’s working years (when taxpayers are saving for retirement) and later, when people are older and withdrawing taxable income from tax-deferred accounts.

PayrollOrg

MAY 31, 2023

PayrollOrg’s Government Relations Task Force State and Local Topics Subcommittee offered concerns and recommendations about Missouri S.B.

Money Talk

DECEMBER 29, 2021

There were also COVID-19 related scams including those for fake tests, vaccines, charities, and government benefits. Income Taxes- Tax filing was pushed back to May 17 and advance child tax credits were sent to income-eligible families with children from July to December. More mandatory state run auto-IRAs were set up.

Money Talk

MARCH 29, 2023

Last year, I wrote a post that described the pros and cons of filing your income taxes by paper or electronically (e-filing). Looking back, it was also a “personal pep talk” for me because I knew I was part of a dying breed of paper income tax filers. of tax returns are filed by paper or, in numerical terms, nearly 13.2

WEX Inc.

JULY 24, 2024

With governments globally encouraging adoption, businesses that have yet to even consider electric vehicles are starting to look at how they might adopt EVs as a part of their commercial vehicle fleets. Globally, governments are increasingly pressuring businesses and citizens to adopt EVs; many countries (the U.S.

Employee Benefits

NOVEMBER 17, 2022

Autumn budget 2022: The government has decided to maintain the current freeze on employers’ national insurance (NI) contribution thresholds for a further two years. “A lower tax regime keeps unemployment low, maximises government receipts through income tax and corporation tax.

Money Talk

MAY 31, 2023

Tax Planning - Until 12/31/25, taxes are “on sale.” Nobody has a crystal ball, but we know that tax rates will rise starting in 2026 when the Tax Cuts and Jobs Act expires. There are only two ways to reduce taxes: 1. When the government lowers tax rates. Make less income and 2.

Money Talk

MARCH 2, 2023

Last year, I noticed a new trend that has continued into 2023: ads on social media about online financial seminars focused on required minimum distributions (RMDs) and income taxes owed in later life. Tax diversification throughout one’s working years can reduce taxes in later life, 2.

PeopleKeep

AUGUST 28, 2024

With the QSEHRA, you can provide health benefits to your workforce in a tax-efficient manner. However, failure to comply with the rules governing this arrangement can lead to costly penalties and legal implications. That’s not the case with the qualified small employer health reimbursement arrangement (QSEHRA).

Money Talk

MAY 11, 2023

If taxpayers are near the top of a marginal tax bracket , RMDs can move them up to a higher tax bracket. Use of RMD Withdrawals - A chunk will pay income taxes. After that, the government does not care what taxpayers do with RMDs. Managing income tax and IRMAA income brackets is a key challenge for these taxpayers.

Money Talk

APRIL 12, 2023

Acronyms associated with impact investing include SRI (socially responsible investments) and ESG (environmental, social, and governance). placing savings in taxable, tax-free, and tax-deferred accounts). convert a traditional IRA to a Roth IRA) because the Tax Cuts and Jobs Act was “time-boxed.”

Money Talk

AUGUST 26, 2021

A recent article in the Wall Street Journal described a new investment trend: “Wealthy Americans eyeing potential tax increases are helping drive record amounts of money into municipal bond funds.” It also went on to state that tax-free U.S. With these trends in mind, now is a good time to review some basics about tax-free (a.k.a.,

Money Talk

FEBRUARY 1, 2023

I-bonds, like any other government bond, are a loan to a government entity, in this case, the federal government. 178.36) through Treasury Direct and up to $5,000 (in different increments) of “old school paper I-bonds” (like I have) via a tax refund. savings bonds were no longer issued by financial institutions.

Money Talk

MARCH 15, 2023

No Federal Insurance - There is no federal government insurance for annuities as there is for bank products (FDIC) and investment products (SIPC). Three Types- Fixed annuities are like CDs, only tax-deferred, and guarantee a certain interest rate for a specified time period. Best, Duff and Phelps, and Standard and Poor’s).

Money Talk

SEPTEMBER 30, 2022

Many are middle income taxpayers who diligently saved and invested for 4-5 decades in tax-advantaged plans. As I wrote in my book Flipping a Switch , some older adults must “plan for higher taxes in the future, especially when required minimum distributions (RMDs) kick in.” IRMAA surcharges. to $573.30 for Medicare Part B and $12.40

Money Talk

DECEMBER 22, 2021

An example is pensions for federal government workers and military retirees and disabled veterans. Income Tax Changes - Each year, income ranges for federal marginal tax brackets are indexed for inflation. Income Tax Changes - Each year, income ranges for federal marginal tax brackets are indexed for inflation.

Employee Benefits

JANUARY 13, 2023

The government has launched a consultation into the way holiday pay and entitlement is calculated for temporary, part-year and zero hours workers. The government is seeking responses from employers, workers, business representative groups, unions, and those representing the interests of groups in the labour market.

HR Lineup

JULY 4, 2024

Transit Passes Transit passes are a popular form of commuter benefit where employers provide employees with pre-tax transit passes or reimbursements for public transportation expenses. Tax Savings: Both employers and employees can enjoy tax advantages. Employers can also save on payroll taxes. For Employers 1.

Money Talk

JANUARY 4, 2024

Free money does not have any work requirement, however, and is often income tax-free. Common sources are businesses, individuals, and the government. 50% for a fifty cent per employee dollar saved match) and is taxed as ordinary income in retirement. Like inheritances, life insurance is generally not subject to income tax.

Money Talk

FEBRUARY 25, 2022

I am one of the 10 million or so tax filers that the IRS probably hates. I continue to file my taxes on paper. But the process is cumbersome and it is so much easier for me- as an admitted frugal tax geek- to fill out paper forms, double check my math, and priority mail my tax return. It is like piecing together a quilt.

Employee Benefits

JANUARY 3, 2024

The UK government has implemented reforms to simplify holiday pay calculations and entitlement as per the Working Time Regulations. The post Government introduces holiday pay and entitlement reforms appeared first on Employee Benefits. weeks paid at basic rate while retaining the two different types of leave.

Employee Benefits

JULY 22, 2024

Reeves will additionally work with Jim McMahon, minister of state at Ministry of Housing, Communities and Local Government, on the investment potential of the £360 billion Local Government Pensions Scheme, which manages the savings of those working to deliver local services, as well as how to tackle the £2 billion spent on fees.

Qandle

JANUARY 29, 2025

For companies of all sizes, adhering to labor rules, tax laws, and industry standards is a major challenge. Compliance risk in payroll refers to the potential for errors, omissions, or violations of laws and regulations that govern employee compensation. Payroll management is a crucial responsibility for any business.

WEX Inc.

JUNE 20, 2024

Tax deductions if you have a fleet of commercial vehicles Are you a small or large business owner with commercial vehicles, or a fleet manager? Calculating your commercial vehicle spend and how it will be impacted at tax time, including mileage and leasing, can make a huge difference in your overall expenses.

Employee Benefits

NOVEMBER 9, 2023

The government is to legislate to retain rolled-up holiday pay for irregular hours, zero hours and part-year workers and set out that it must be calculated based on total earnings in the pay period. The post Government to legislate to retain rolled-up holiday pay appeared first on Employee Benefits.

HR Digest

JUNE 23, 2023

Imagine a scenario where you are rewarded with a hefty sum of $26,000 per employee, just by gathering some data and filling out a tax form. Well, this isn’t a fantasy, it’s the reality of the Employee Retention Tax Credit (ERC). Your ERC Tax Credit is on its way! Sounds like a dream, right? Yes, you read that right.

PeopleKeep

JULY 6, 2022

If you have remote employees in other states than where your organization is located, taxes can be challenging. With so many people working from home, employers and state governments face new challenges regarding taxation, nexus, and employee benefits.

Money Talk

MAY 4, 2023

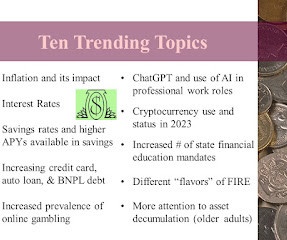

Inflation-induced price hikes on goods and services are like a regressive sales tax and hurt those with low incomes the most. Below is a brief description of the ten trends that I discussed: Inflation- The U.S.

Employee Benefits

DECEMBER 6, 2022

The UK government has committed to introducing secondary legislation entitling employees to the ability to request flexible working from the first day of their employment. The post Government commits to making flexible working day one right appeared first on Employee Benefits.

PeopleKeep

SEPTEMBER 13, 2021

federal government created the small business health care tax credit to help small businesses contribute to their employees’ health benefits. However, not all small businesses are eligible for a tax credit, and there are certain steps you need to take to ensure your organization qualifies. That’s why the U.S.

Employee Benefits

NOVEMBER 17, 2022

Autumn budget 2022: The government has agreed to raise the national living wage by 9.7% The national living wage is the rate set by the government as a legal minimum for employees aged above 23. The move is part of the government’s attempts to reach a national living wage rate of two-thirds of median UK earnings by 2024.

Ahmed's Universe

SEPTEMBER 28, 2013

The only thing growing at double-digit figures in Brazil are prices There are several reasons why prices are so high: poor infrastructure, red tape, high taxes, low productivity. I would single out two of these: high taxes and low worker productivity. High taxes are not in and of themselves a bad thing.

WEX Inc.

AUGUST 28, 2024

Testing shows whether or not your tax-advantaged plans are discriminating in favor of highly compensated employees or key employees. The IRS requires non-discrimination testing for employers who offer plans governed by Section 125 , which includes a flexible spending account (FSA). What plans require non-discrimination testing?

Employee Benefits

APRIL 11, 2024

The post Government launches new disability guide with CIPD appeared first on Employee Benefits.

Money Talk

SEPTEMBER 22, 2022

absenteeism, presenteeism, labor shortages, disability payments, and costs of errors made by impaired workers), and governments (e.g., criminal justice and incarceration expenses and reduced income tax and FICA tax revenue). The costs of opioid addiction affect individuals and families, employers (e.g.,

HR Lineup

SEPTEMBER 15, 2021

Kronos served not only private entities but also government firms, regardless of size. Paycor not only contains basic payroll, tax compliance, and attendance information, but it also includes tools to help recruit and maintain talented staff and helps form a business community within your company.

Money Talk

APRIL 6, 2023

Streamlined Portability - There needs to be a more streamlined process for workers who are leaving jobs to rollover their retirement account balances to another tax-deferred plan, thereby preventing leakage. doing nothing) is a cadre of destitute older people falling back on limited government resources. The alternative (i.e.,

Patriot Software

AUGUST 26, 2022

With each payroll, you and your employees have to pay taxes. You collect and remit the money, but what are payroll taxes used for? What does the government do with that money? We’ve got a list of each employment tax you withhold and/or contribute and where the money goes. If you’re curious, read on.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content